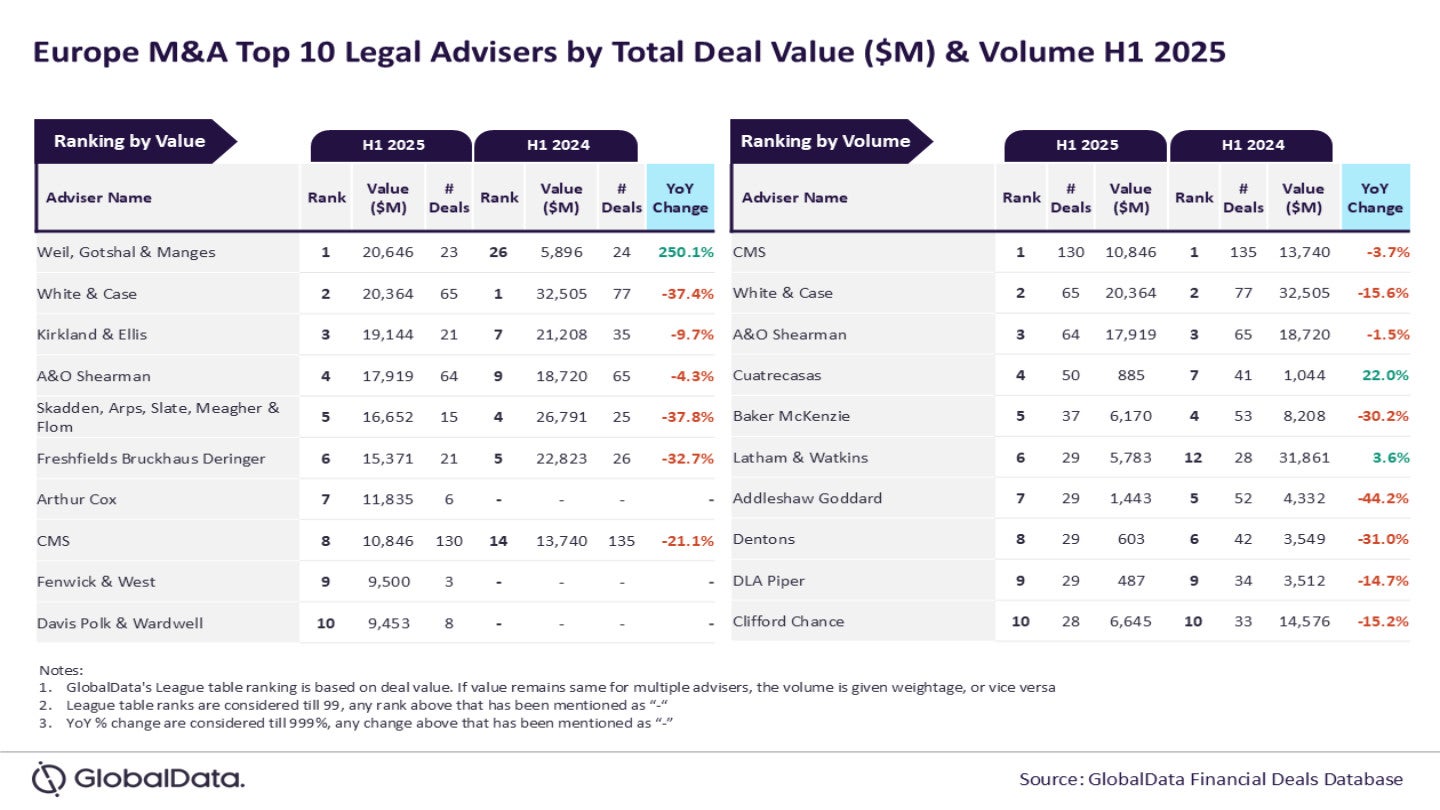

Weil, Gotshal & Manges and CMS lead European M&A legal advisers in H1 2025

Weil, Gotshal & Manges and CMS have emerged as the leading legal advisers in the European mergers and acquisitions (M&A) sector for the first half (H1) of 2025, according to the latest league table published by GlobalData.

The report ranks legal firms based on the value and volume of M&A transactions they have facilitated.

Weil, Gotshal & Manges secured the top position in terms of deal value, advising on transactions amounting to $20.6bn.

In contrast, CMS led in deal volume, having provided counsel on 130 transactions during the same period.

GlobalData lead analyst Aurojyoti Bose said: “CMS was the clear winner by volume, outpacing its peers by a significant margin in H1 2025. It was the only adviser with triple-digit deal volume during the review period. Apart from leading by volume, CMS also held the eighth position by value in H1 2025.

“Meanwhile, Weil, Gotshal & Manges faced close competition from White & Case for the top position by value during H1 2025. It is noteworthy that White & Case was the top adviser by value in H1 2024 and missed the leadership position in H1 2025 by a whisker. While White & Case registered a decline in the total value of deals advised by it during H1 2025 compared to H1 2024, Weil, Gotshal & Manges registered more than a triple-fold increase. Resultantly, Weil, Gotshal & Manges’ ranking by value jumped from 26th position in H1 2024 to the top position in H1 2025.”

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataThe analysis from GlobalData’s Deals Database indicates that White & Case ranked second in value, advising on $20.4bn in deals.

Kirkland & Ellis followed closely with $19.1bn, while A&O Shearman and Skadden, Arps, Slate, Meagher & Flom reported $17.9bn and $16.7bn, respectively.

In terms of volume, White & Case also secured the second position with 65 deals, followed by A&O Shearman with 64 transactions. Cuatrecasas and Baker McKenzie completed the list with 50 and 37 deals, respectively.

GlobalData’s league tables are based on the real-time tracking of thousands of company websites, advisory firm websites and other reliable sources available on the secondary domain. A dedicated team of analysts monitors all these sources to gather in-depth details for each deal, including adviser names.

To ensure further robustness to the data, the company also seeks submissions of deals from leading advisers.

Sign up for our daily news round-up!

Give your business an edge with our leading industry insights.

Content Original Link:

" target="_blank">