Grant Cardone Just Explained The Top Mindset Shift That Separates The Rich From Everyone Else

The way you think about money and accumulating wealth will impact your ability to achieve long-term financial goals. While there are many ways to think about money, financial guru Grant Cardone recently laid out the difference that separates the rich from everyone else.

"The wealthy invest in assets that can NOT be consumed," he said in a recent X post.

He went further, explaining that others buy things to consume, such as cars, houses, and non-essential items that take up space in their homes. Here's how you can use this insight to build wealth.

Don't Miss:

-

Deloitte's fastest-growing software company partners with Amazon, Walmart & Target – Many are rushing to grab 4,000 of its pre-IPO shares for just $0.30/share

-

Named a TIME Best Invention and Backed by 5,000+ Users, Kara's Air-to-Water Pod Cuts Plastic and Costs — And You Can Invest At Just $6.37/Share

Monitor What You Buy

It's okay to buy some things that don't count as investments, but you should invest more money than you spend on discretionary items. Cardone is an advocate for pouring most of your earnings into assets during your early years so they can compound faster in the long run.

He also believes professional athletes should invest most of the money they make instead of spending the funds to live a lavish lifestyle. This advice doesn't only apply to athletes. Eventually, you won't be able to earn as much as you're currently earning, especially if you are at the peak of your career. When that point arrives, you will have to live in your investments.

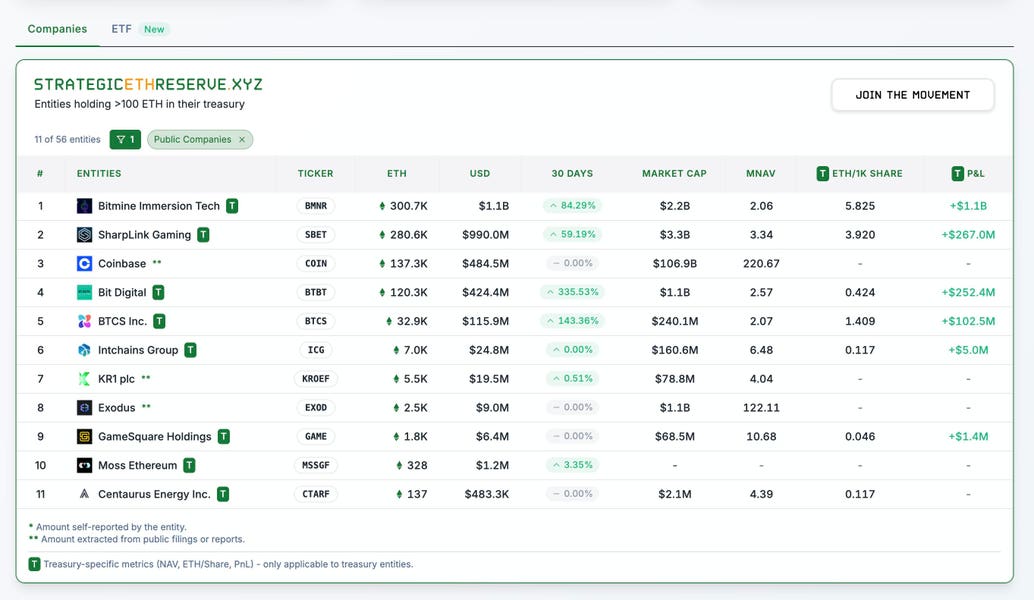

Cardone identified cryptocurrencies, stocks, real estate, and art as assets. Putting your money into investments you understand the most is a more effective use of your capital than luxury items that don't count as tax write-offs.

Trending: This AI-Powered Trading Platform Has 5,000+ Users, 27 Pending Patents, and a $43.97M Valuation — You Can Become an Investor for Just $500.25

Set Investment Goals

It's hard to set an investment goal around achieving a set return each year. For instance, if you aspire to earn a 10% return on your investments this year, a lot of it is out of your control. You can invest in stocks that have a better chance of beating the market, but there are many variables that you cannot control.

Instead of setting goals around a specific return or portfolio size, focus on increasing how much you invest in assets each month. If you currently invest $1,000 into the stock market each month, map out how you can invest $2,000 each month.

Having this goal can sprout new ideas, such as picking up a side hustle, asking for a raise, job hopping, or learning high-paying skills. Many people know that you can do those things to increase your income. However, if you raise your investment goals and have a strong motivation to achieve your objective, it's easier to stay disciplined and take the necessary actions that result in a higher income.

Content Original Link:

" target="_blank">