Bitcoin is nearly double where it was a year ago. This is what's behind the run

The technical setup has added to the momentum.

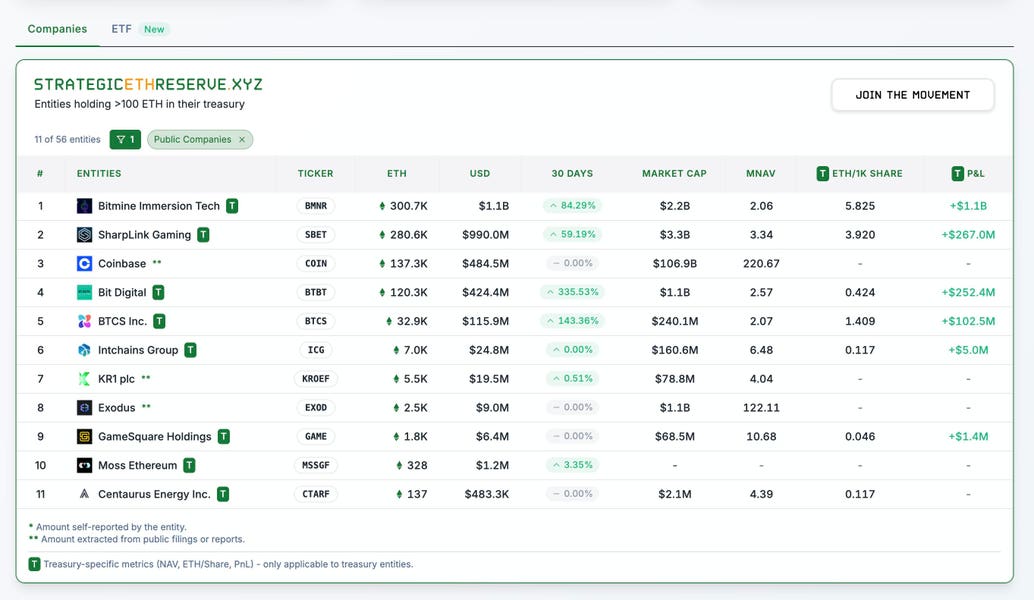

June options expiry flushed out selling pressure and triggered a short squeeze, as traders who bet against bitcoin near the $110,000 to $120,000 range were forced to cover. Bitcoin's futures open interest hit a record above $88 billion, a sign of growing conviction from institutions. Ethereum open interest has also been hovering near all-time highs.

Bitcoin has also reestablished its correlation with the Nasdaq.

After temporarily decoupling during the ETF-driven surge, it's now back in sync with tech stocks. The Nasdaq closed at a record high Monday, helping lift sentiment across risk assets — including ether, solana, and XRP.

And now, long-awaited policy clarity may finally be on the way in Washington.

In May, the Department of Labor cleared the path for 401(k) plans to offer access to Bitcoin ETFs, opening the door to retirement savings allocations and deepening the institutional base.

This week, the House is taking up a trio of landmark crypto bills, in what Republican lawmakers are calling "Crypto Week." The legislation includes a framework to divide oversight of digital assets between the Securities and Exchange Commission and the Commodity Futures Trading Commission, new rules for stablecoins, and a bill to block the creation of a central bank digital currency.

While none of the proposals directly target bitcoin, the broader message is clear: Washington is finally beginning to draw the contours of a regulatory regime, and traditional finance is already positioning around it.

Until now, asset managers, banks, and trading platforms have largely stayed on the sidelines, deterred by a wave of SEC enforcement actions and the legal uncertainty over what counts as a security versus a commodity.

The Clarity Act would settle that debate. It would give the CFTC jurisdiction over digital commodities like bitcoin — and potentially ether — while narrowing the SEC's domain.

It's exactly the kind of legal bright line compliance officers have been pleading for.

The bill also aims to clear a path for broker-dealers to handle crypto lawfully. Down the road, it could open the door for institutional decentralized finance by allowing traditional firms to experiment with on-chain finance without immediately triggering exchange or clearinghouse registration requirements.

WATCH:JPMorgan announces plans to charge for access to customer bank data

Content Original Link:

" target="_blank">