Water Technology Merger: Greek Unibios to Acquire Majority of France’s Osmosun

Unibios Holdings S.A., a Greece-based investment group focused on environmental technologies, is poised to acquire a 65% majority stake in Osmosun S.A., a French company specializing in solar-powered desalination. The deal will be executed through Unibios’ Luxembourg-based water treatment subsidiary, Watera International S.A., marking a strategic expansion of its footprint in the global water reuse and treatment sector.

The acquisition will be completed through a combination of cash and equity contributions. Unibios will contribute €1.61 million in cash and transfer 30% of Watera International’s share capital to Osmosun. An additional €390,000 in cash will be invested by several long-standing Osmosun shareholders to support the transaction.

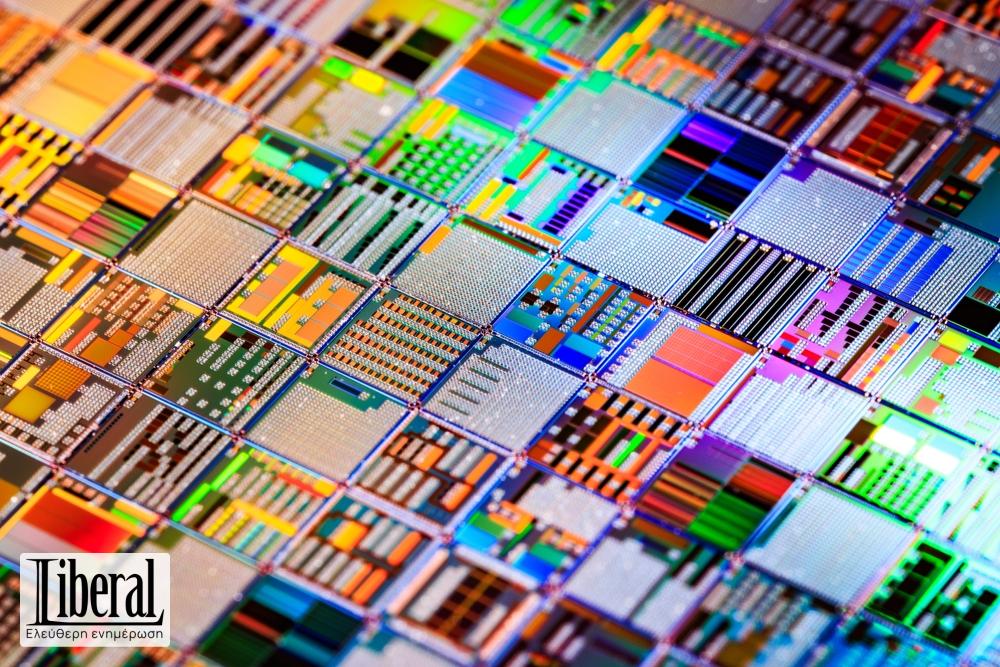

Osmosun, listed on Euronext Growth Paris under the ticker ALWTR, was founded in 2014 and is headquartered in Gellainville, France. The company designs, manufactures, and installs desalination systems that use solar energy to convert seawater and brackish water into potable water. Its patented OSMOSUN® technology is capable of operating without batteries, using solar energy during the day and switching to the grid or alternative energy sources when needed for 24-hour operation. With more than 70 installations across 27 countries, Osmosun serves a wide range of sectors, including remote communities, municipalities, hotels, mining operations, and humanitarian emergency sites.

The transaction is subject to shareholder approval at Osmosun’s general meeting scheduled for June 30, 2025. Shareholders will base their decision on an independent expert’s report that will assess the fairness of the proposed deal. Shareholders representing over 65% of Osmosun’s capital have already committed to supporting the transaction, indicating strong backing from within the company.

Completion of the deal also hinges on regulatory clearance from the French financial markets authority, the Autorité des Marchés Financiers (AMF). Unibios is seeking a waiver from the AMF that would exempt it from launching a mandatory public offer for the remaining Osmosun shares. Another condition is the approval of Osmosun’s 2024 financial statements by its shareholders.

As of May 22, 2025, Osmosun had a market capitalization of approximately €5.3 million. The transaction values the company at €4.042 million, or €0.72 per share. Upon completion, Unibios will hold 65% of Osmosun’s share capital and voting rights. Osmosun will then become the parent company of Unibios’ Water Treatment division, integrating its own operations with those of Watera.

According to Unibios’ financial disclosures, the assets being transferred to Osmosun have a book value of €4.97 million. In return, Unibios expects to receive approximately 11.43 million Osmosun shares, valued at around €10.8 million based on the share price as of May 22.

Following the deal, Unibios anticipates several changes to its consolidated financial statements. Minority interests are expected to rise by €2.5 million, equity attributable to shareholders will decrease by €2.1 million, and total equity will increase by €0.4 million.

Unibios views this acquisition as a strategic move grounded in the value of Osmosun’s patented desalination technology and its appeal in the growing market for sustainable water solutions. Watera’s efficient manufacturing capabilities are expected to reduce production costs for Osmosun’s products, making them more competitive. Watera’s established sales and marketing infrastructure will also help drive international growth. Conversely, Watera gains access to key water reuse and treatment markets in France and other French-speaking regions, benefiting from Osmosun’s market presence and technical expertise. As a result, Osmosun’s financial performance is expected to improve significantly following the integration of Watera’s operations.

Assuming regulatory approval from the AMF, the transaction is expected to close on June 30, 2025. There will be no changes to the shareholder structure of Unibios as a result of the deal.

Content Original Link:

" target="_blank">