Insurers should implement AI across the entire value chain

Underwriting and risk profiling is the area of the insurance value chain most positively impacted by AI, according to a GlobalData poll of industry insiders. However, the proportion of respondents selecting this area has declined from 2023–2025, suggesting growing interest in other applications of AI across the sector.

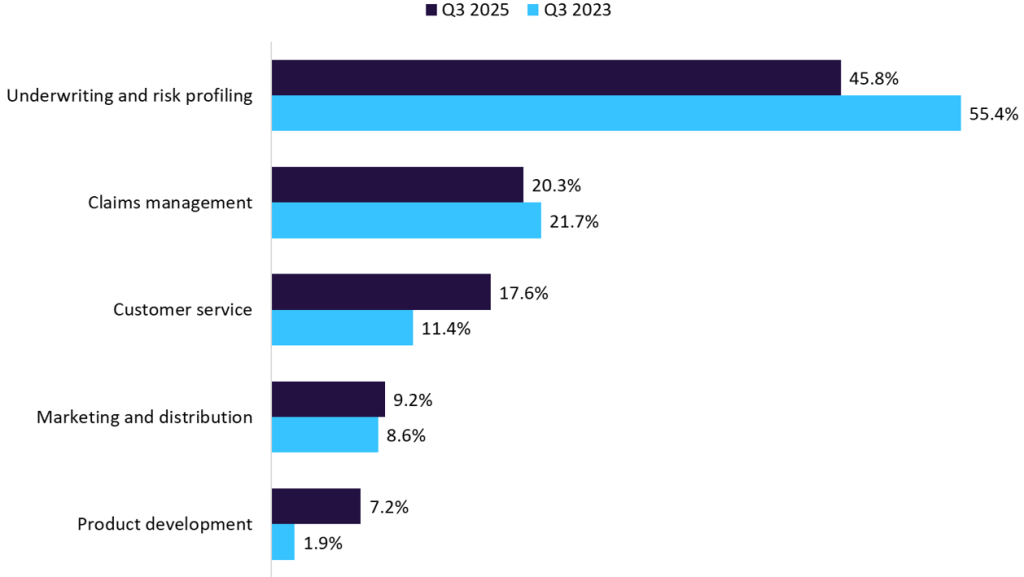

GlobalData’s poll run on Verdict Media sites in Q3 2025 has found that 45.8% of industry insiders believe underwriting and risk profiling is the area of the insurance value chain most positively impacted by AI. This was followed by claims management (20.3%) and customer service (17.6%). However, compared to Q3 2023, the proportion selecting underwriting and risk profiling fell by 9.6 percentage points (pp), and those selecting claims management dropped by 1.4pp. In contrast, customer service saw a 6.2pp increase, while product development rose from 1.9% to 7.2%, indicating a broadening perception of AI’s potential across the value chain.

Go deeper with GlobalData

Which area of the insurance value chain will most positively impacted by AI? Q3 2023 – Q3 2025

The shift in perceptions likely reflects the growing maturity and broader application of AI across the insurance value chain. While underwriting and risk profiling remains a key area, adoption has plateaued somewhat as insurers face challenges around regulatory compliance, data quality, and fairness concerns in risk models. At the same time, significant improvements in AI-powered automation, especially in customer service—such as faster response times, better triaging, and improved satisfaction—have led to increased confidence in its impact there. Similarly, the rise of product development reflects insurers using AI to analyse market trends, identify coverage gaps, and accelerate innovation in new offerings, which has become a bigger strategic focus as competition intensifies.

To stay competitive, insurers should invest in developing AI capabilities across the entire value chain. This includes enhancing customer service with intelligent automation, using AI-driven insights to guide product innovation, and improving claims efficiency. Crucially, they must also ensure transparency, fairness, and regulatory compliance in all AI applications to build trust and long-term value.

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataContent Original Link:

" target="_blank">