Kaspa: The Israeli Answer To Scaling Bitcoin

Blockchain. The image is a made up 3D concept render.

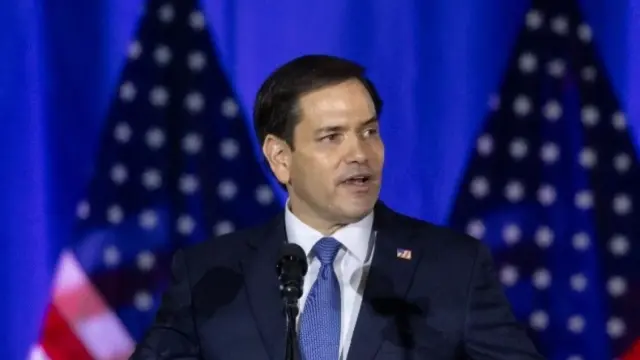

In the ever-evolving crypto landscape, a relatively quiet contender is making waves by rewriting the rules of Proof-of-Work blockchains - Kaspa. A project born from Israeli academic research - Kaspa is leveraging a novel protocol called GHOSTDAG to overcome Bitcoin’s biggest limitation: speed. Invented by Hebrew University researchers Yonatan Sompolinsky, Shai Wyborski, and Aviv Zohar, GHOSTDAG transforms the traditional blockchain into a blockDAG (directed acyclic graph of blocks), allowing parallel blocks and sub-second confirmation times without sacrificing security.

As of May 2025, Kaspa’s KAS token trades around $0.10, giving the network a market capitalization near $2.7 billion - a top-50 crypto that sprang from a university idea into a growing ecosystem.

Breaking Bitcoin’s Speed Limit with Kaspa

Bitcoin’s original blockchain protocol deliberately prioritizes security over speed, using a system called Proof-of-Work to reach consensus. In this model, miners compete to solve complex mathematical puzzles, and the first to succeed earns the right to add the next block to the chain. Satoshi Nakamoto’s design enforces a 10-minute block time to ensure that each new block has time to fully propagate across the network before the next race begins. This helps minimize “orphaned” blocks - valid blocks that arrive too late - but also severely limits throughput and responsiveness, highlighting a fundamental tradeoff between trustless consensus and scalability.

Litecoin improved on this slightly with 2.5-minute blocks and lower fees, making it more suitable for day-to-day transactions. Still, it inherits the same single-chain architecture and scalability ceiling.

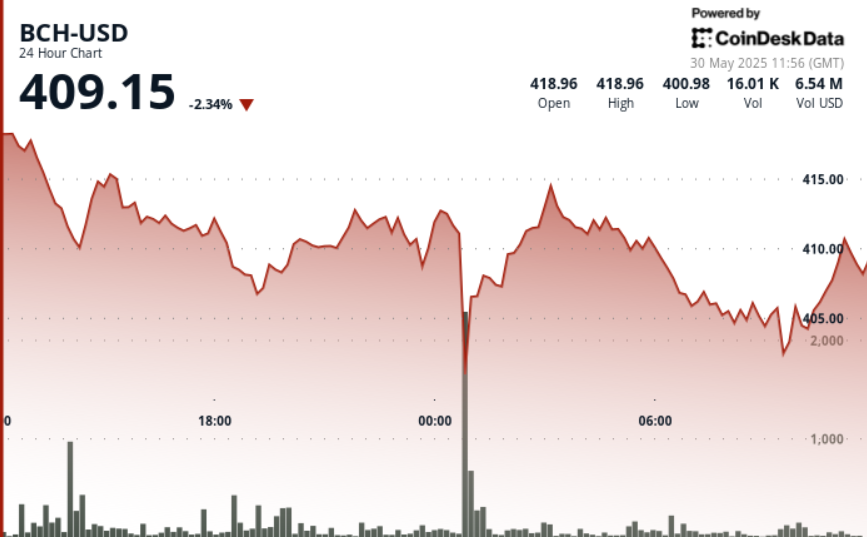

Bitcoin Cash took the big-block route, increasing capacity by allowing up to 32 MB per block. This boosts potential throughput but raises centralization concerns, as larger blocks demand more bandwidth and storage.

Monero focuses on privacy and adaptability, with a 2-minute block time and dynamic block sizes. Its CPU-friendly RandomX algorithm promotes mining decentralization, though it's not built for high TPS. Instead, it scales by remaining resilient under real-world constraints.

Lastly, to address Bitcoin’s scalability without altering its base layer, developers introduced the Lightning Network - a Layer 2 solution for off-chain payments. It enables instant, low-fee transactions by opening payment channels between users, settling only the final balances on the main chain. While powerful in theory, Lightning faces challenges in liquidity management, user experience, and routing reliability. It’s a promising complement to Bitcoin, but still far from mass adoption — and it doesn’t solve on-chain throughput limitations for broader use cases.

Blue blocks vs Red blocks.

GHOSTDAG takes a fundamentally different route. Instead of insisting on one-block-at-a-time and orphaning any “competing” blocks, GHOSTDAG allows multiple blocks to coexist and orders them in consensus. In traditional blockchains, if two miners produce blocks simultaneously, one block wins and the other is thrown away. Kaspa’s protocol doesn’t waste those blocks - it weaves all mined blocks into a structured DAG, picking an ordering such that the network eventually agrees on the same ledger. The protocol splits blocks into a “blue set” versus “red set,” essentially distinguishing the blocks mined by honest, cooperative nodes (blue) from those that conflict or might be malicious (red). By favoring the blue set when finalizing the ledger, Kaspa can include many parallel blocks while preserving security and consensus.

Crucially, Kaspa remains a pure Proof-of-Work system, meaning it retains the battle-tested security model of Bitcoin. Kaspa’s consensus uses a custom hashing algorithm (kHeavyHash) and was launched with no premine, no ICO, and no central governance, much like Bitcoin’s fair launch ethos. Every KAS coin has been mined into circulation by the community, which has cultivated a fiercely loyal base of miners and supporters.

Sub-Second Blocks and Scalability Upgrades

Blocks on Kaspa were initially targeting roughly 1 block per second, and thanks to a recent upgrade, that rate increased by an order of magnitude. In May 2025, Kaspa’s network implemented the “Crescendo” hard fork, boosting block production from 1 to 10 blocks per second (BPS).

These sub-second blocks allow Kaspa to handle a high volume of transactions in parallel - far more than the 7 transactions per second often cited as Bitcoin’s limit. In tests, the Kaspa network achieved first transaction confirmations in mere seconds, handling around 40 transactions per second – a throughput higher than what Bitcoin or even Ethereum have ever sustained.

Litecoin and other first-generation Proof-of-Work coins mentioned above only modestly improved throughput by tweaking parameters (Litecoin’s 4× faster blocks, slightly bigger block size, etc.), but they could not break the fundamental bottleneck: any significant speed-up in a single-chain Proof-of-Work system tends to cause more forks and threaten consensus stability. Kaspa’s multi-block DAG approach side-steps this issue by absorbing orphaned blocks into the ledger rather than fighting them. As a result, Kaspa can push the block time down to seconds or less - and the successful 10 BPS upgrade demonstrates the network’s confidence in handling that scale.

Community-Driven Growth and Miner Adoption

Kaspa’s journey from academic concept to a multi-billion-dollar network has been largely community-driven. There was no flashy VC-marketed token sale to kick it off; instead, early development was funded by an $8 million investment into DAGLabs, a startup co-founded by Sompolinsky to commercialize blockDAG research. After Kaspa’s mainnet launch in November 2021, DAGLabs was dissolved and the project handed over to the open-source community.

A bottom-up marketing approach has kept Kaspa in the conversation without the “influencer pumps” or paid hype that many crypto projects rely on. The result is an authentic, technically literate following that genuinely believes in the tech.

Fred Thiel, chairman and chief executive officer of Marathon Digital Holdings. Photographer: Valerie ... More Plesch/Bloomberg

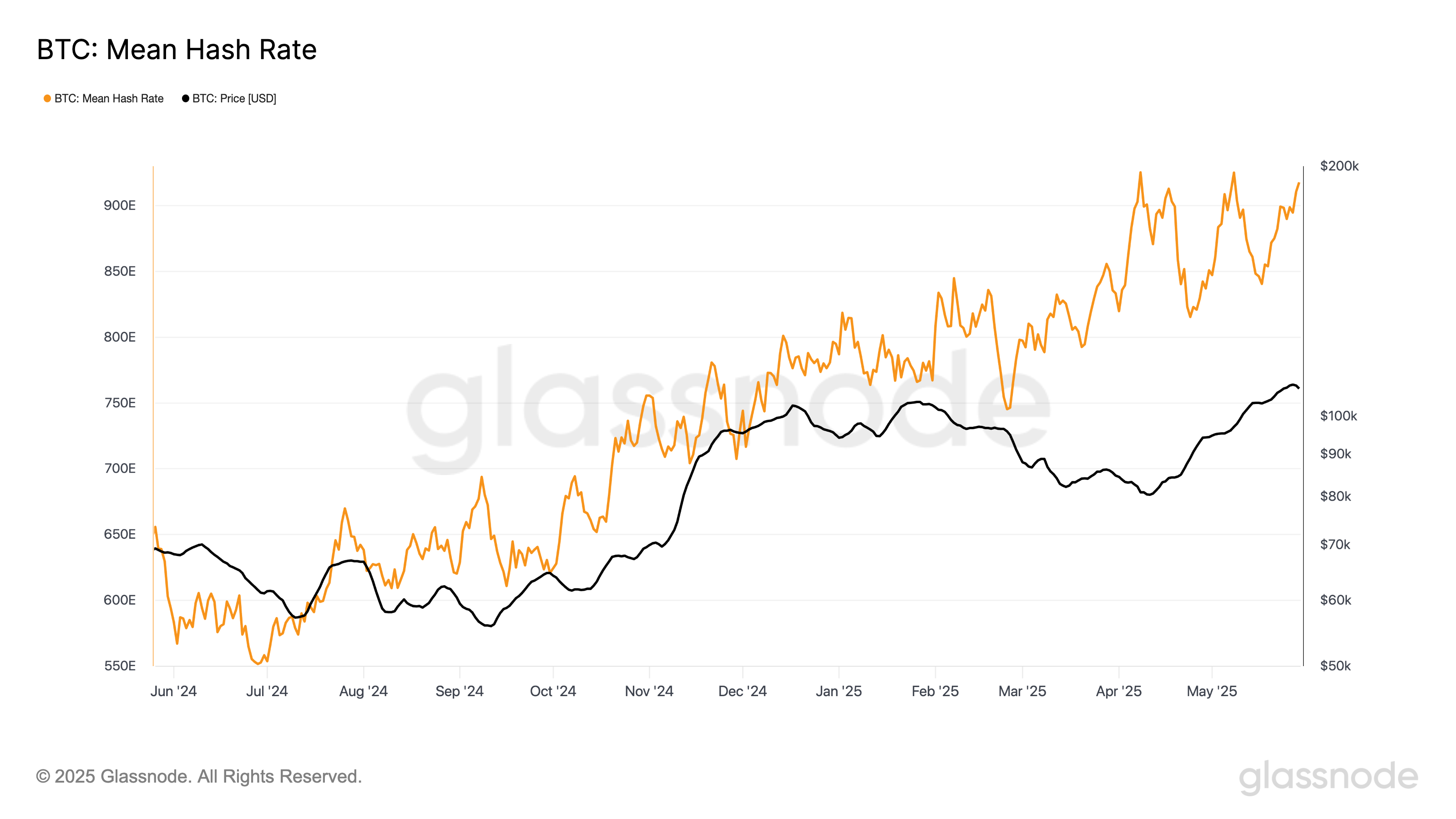

That ethos has attracted not just armchair supporters, but serious miners. In mid-2024, Marathon Digital Holdings, one of North America’s largest Bitcoin miners, revealed it had mined $16 million worth of KAS to diversify its revenue. Even though Marathon emphasized it wasn’t pivoting away from Bitcoin - Kaspa would be only a small fraction of its total hashpower - the move was telling. It signaled that Kaspa had entered the big leagues of Proof-of-Work. According to data from June 2024, Kaspa was already the fifth-largest Proof-of-Work cryptocurrency by market cap, trailing only Bitcoin, Litecoin, Bitcoin Cash, and Dogecoin.

Today, Kaspa’s network security is secured by thousands of GPUs and ASICs around the world, and its community continues to push development forward. Recent upgrades have expanded Kaspa’s functionality – for instance, the KRC-20 token standard (akin to Ethereum’s ERC-20) was introduced to lay groundwork for future smart contracts. The project’s roadmap hints at plans for DeFi and dApps, either through native smart contracts or layer-2 integrations.

The Big Picture: Revitalizing Proof-of-Work

Kaspa’s development raises a key question in blockchain research: Can Proof-of-Work scale without compromising decentralization or security? Traditionally, attempts to improve blockchain performance have focused on alternative consensus mechanisms or off-chain solutions. Kaspa presents an alternative - a restructured Proof-of-Work model that uses a blockDAG to increase throughput.

GHOSTDAG, developed by researchers at the Hebrew University of Jerusalem, enables the network to incorporate multiple blocks per second by organizing them into a directed acyclic graph rather than a linear chain. This design allows higher block frequency and parallelism while maintaining consensus.

However, the approach introduces new challenges. Sub-second block intervals demand tighter synchronization across the network, and the protocol’s behavior under sustained high-load, adversarial conditions remains largely untested. Additionally, the long-term effects on miner distribution and node participation are not yet clear, particularly as the system scales.

Kaspa offers a useful case study in protocol design - one that may inform future research on scaling secure, decentralized networks.

Content Original Link:

" target="_blank">