Bitcoin price slips as Fed minutes flag US inflation risks

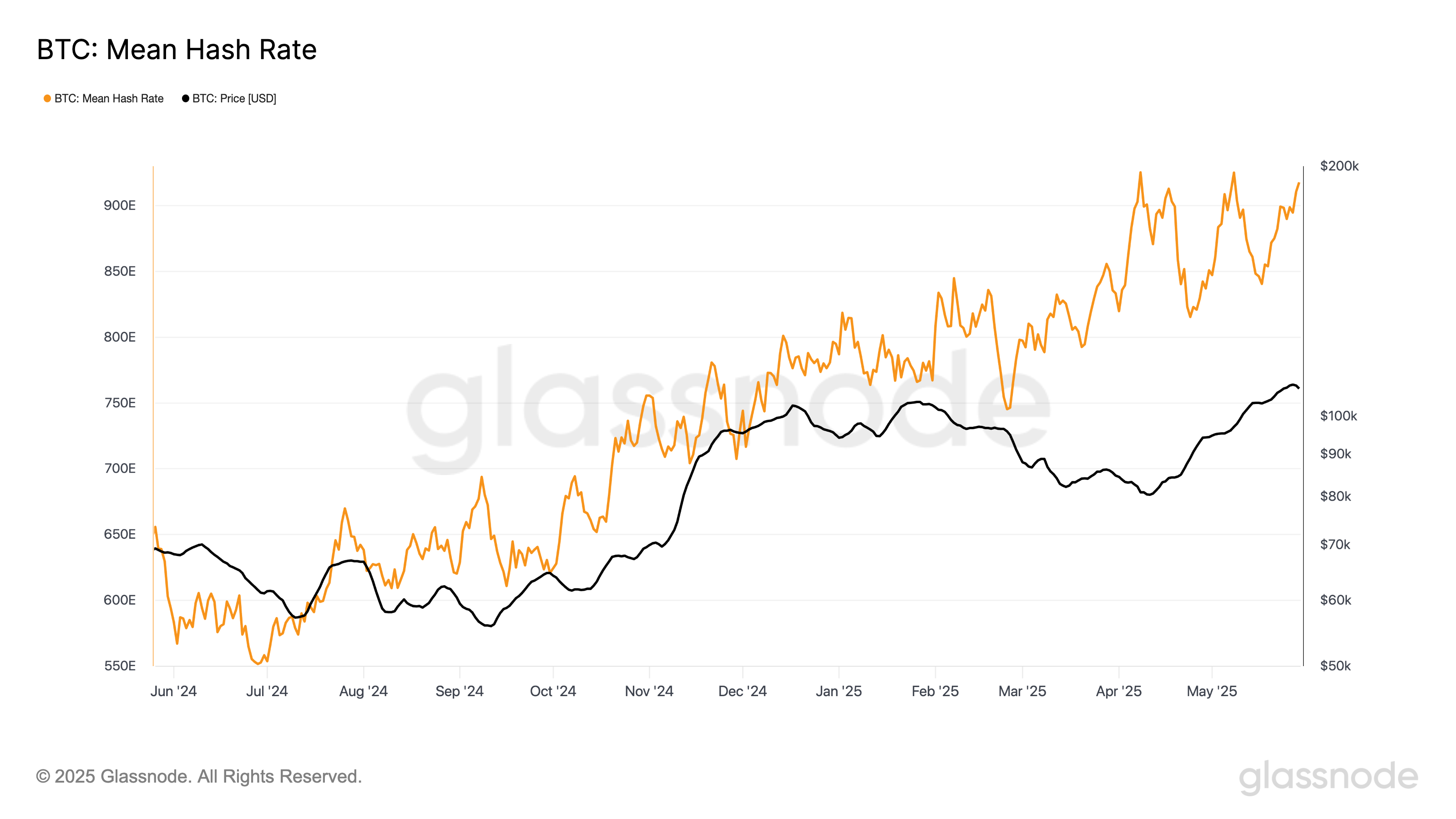

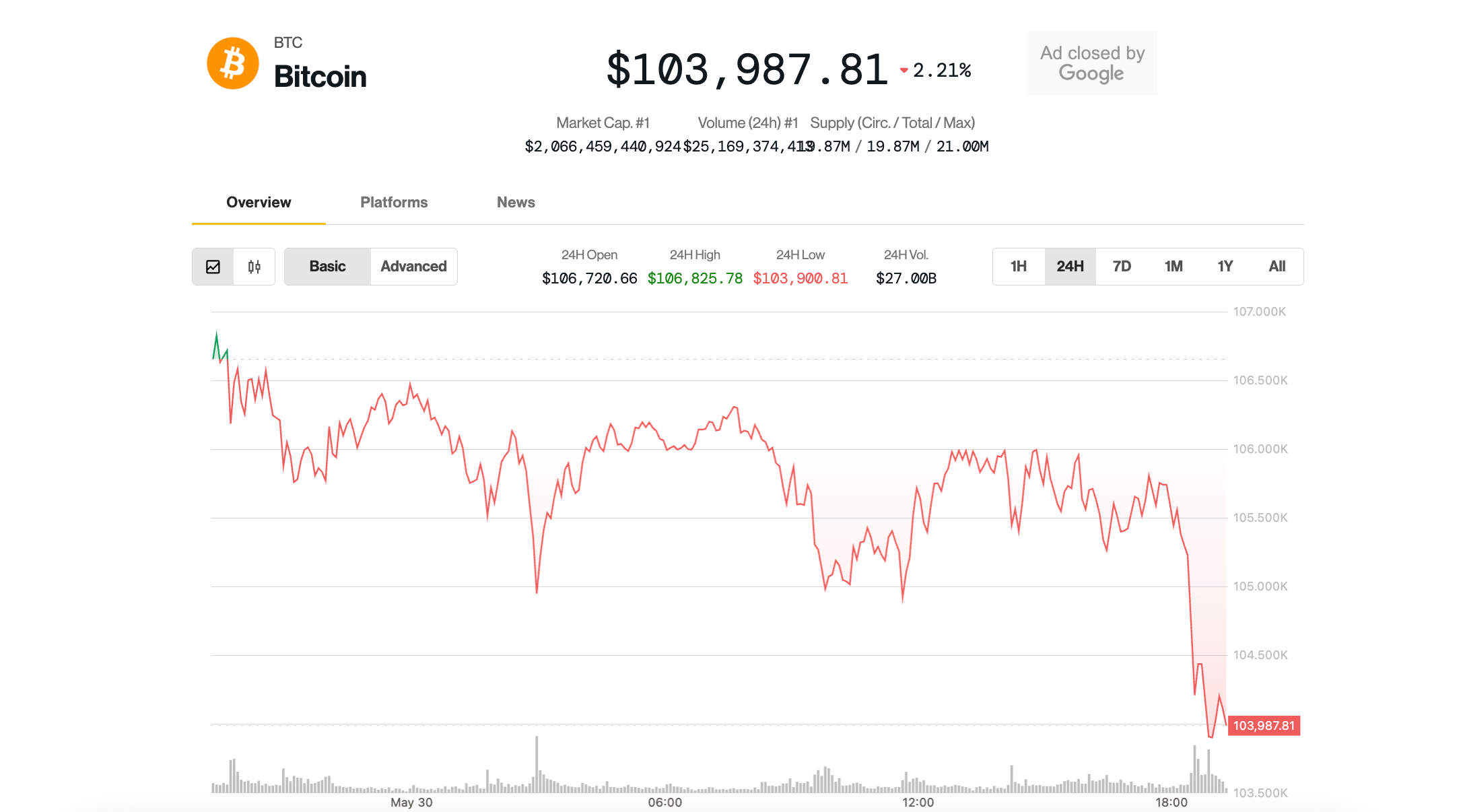

Bitcoin (BTC-USD) dipped by around 1% on Thursday, following the release of minutes from the Federal Reserve’s May policy meeting, which revealed mounting concern over persistent US inflation and the potential for economic slowdown.

Bitcoin was hovering just below $108,000 (£80,244). The dip comes shortly after bitcoin set a new all-time high above $111,000 on 22 May.

The minutes from the 6-7 May Federal Open Market Committee (FOMC) meeting showed Fed officials warning they may soon face “difficult tradeoffs” as inflation remains stubbornly high and unemployment begins to rise.

Read more: Crypto live prices

Officials also highlighted risks to financial stability, pointing to recent bond market volatility and cautioning that shifting perceptions of the US dollar’s safe-haven status could have lasting repercussions for the global economy.

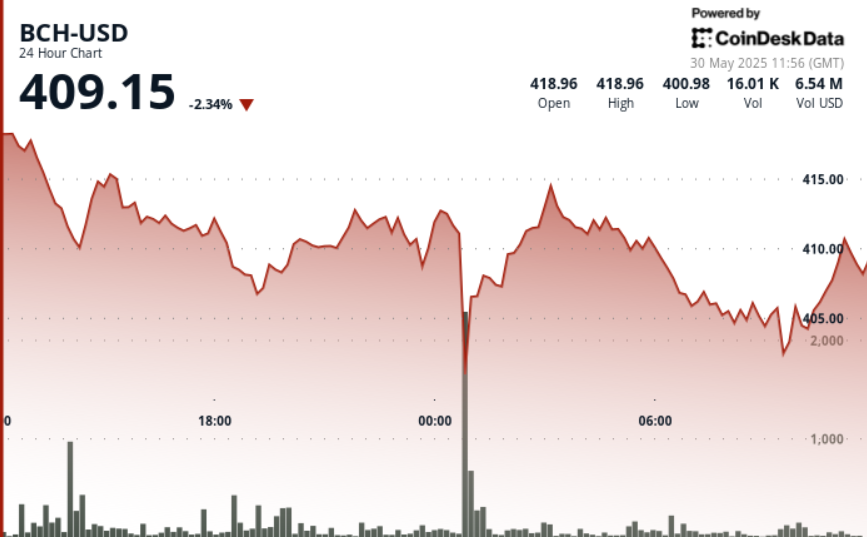

The broader cryptocurrency market also fell on Thursday, with total market capitalisation falling more than 2% to around $3.54tn, according to data from CoinGecko.

“This week’s FOMC minutes and the upcoming Core PCE inflation data arrive at a fragile moment for macro-driven assets like Bitcoin,” Bitfinex head of derivatives Jag Kooner said.

“Traders aren’t just watching for signals on interest rates, they’re looking for insight into how the Fed interprets inflation risks in light of new tariff policies, particularly after the US imposed a 50% levy on EU imports.”

Read more: How Trump and Melania meme coins are performing after 100 days

US equities also edged lower Wednesday. The S&P 500 (^GSPC) slipped 0.6% but remains within 4.2% of its all-time high. The Dow Jones Industrial Average (^DJI) fell 244 points (0.6%), and the Nasdaq Composite (^IXIC) declined by 0.5%.

The market lull came ahead of Nvidia’s (NVDA) eagerly anticipated earnings release, which was published after market close on Wednesday. Nvidia shares dipped 0.5% ahead of the report.

Pre-market trading shows increased optimism

Despite Wednesday's decline, sentiment improved in overnight trading. Futures pointed to a strong open on Thursday in New York as Dow futures were up 1.16%, S&P 500 futures gained 1.47%, and Nasdaq futures jumped 1.82%.

US stock futures rose following a landmark decision by a US trade court on Wednesday that struck down most of president Donald Trump’s "Liberation Day" tariffs, ruling he had exceeded his authority by imposing broad duties on imports from key trading partners.

The Court of International Trade found that the US Constitution grants Congress exclusive power to regulate foreign commerce, a power not overridden by the president’s emergency authority to protect the domestic economy.

Content Original Link:

" target="_blank">