Bitcoin eyes decline below $100,000 amid profit-taking and Trump-Musk clash

- BTC's decline has been sustained by long-term holders' profit-taking, which hit $1.47 billion per day last week.

- President Trump and Elon Musk's clash over the "One Big Beautiful Bill" has added macroeconomic tensions, contributing to Bitcoin's decline.

- Bitcoin could crash to $92,500 if it fails to recover the $103,000 support level.

Bitcoin (BTC) declined 3% on Thursday, erasing more than $84 billion from its market capitalization as intense profit-taking from long-term holders (LTHs) and macroeconomic uncertainty impacted its price. Notably, a clash between President Donald Trump and Tesla CEO Elon Musk over the "One Big Beautiful Bill Act" has caused the top cryptocurrency to shift toward a short-term bearish outlook.

Bitcoin tumbles as macroeconomic conditions and lingering LTH profit-taking hinder momentum

Bitcoin sustained a decline below $101,000 on Thursday, extending its weekly losses to more than 4%. The decline marks the continuation of a trend that began last week, where LTHs continued to exert high selling pressure on the top cryptocurrency.

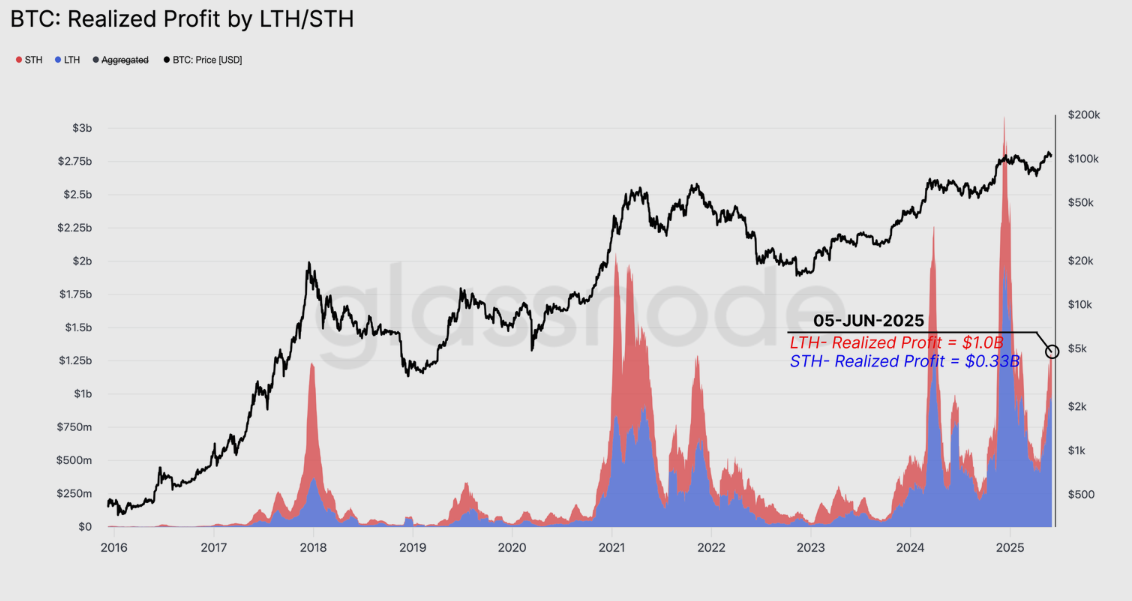

BTC's realized profit peaked at $1.47 billion daily last week, largely dominated by LTHs’ spending, according to Glassnode's weekly report. The 30-day moving average of LTH realized profit climbed to $1 billion per day following Bitcoin's drop below $111,000, outpacing short-term holders' (STHs) $320 million daily profit realization. The surge in realized profits marked the fifth time this cycle that the metric has risen above $1 billion.

"This cohort, often associated with conviction-driven investors, is now taking profits at scale, a behavior that typically signals maturity or exhaustion in a bull trend," Glassnode stated in the report.

BTC Realized Profits by LTH/STH. Source: Glassnode

The increased selling pressure from LTHs is accompanied by rising uncertainty in macroeconomic factors, which have also contributed to Bitcoin's decline. A mix of weak job data, recessionary tensions and Elon Musk's criticism of government spending in the past week have sent Bitcoin downwards.

Musk again condemned President Trump's "One Big Beautiful Bill Act" on Thursday, expressing concerns that it could bankrupt the US economy and increase the government deficit. The bill is projected to add approximately $2.4 trillion to the deficit over the space of 10 years, according to the Congressional Budget Office.

Musk also added that "Trump tariffs will cause a recession in the second half of this year."

President Trump responded by saying Musk is angry because the bill includes the cutting of electric vehicles tax credits.

"Elon was 'wearing thin,' I asked him to leave, I took away his EV mandate that forced everyone to buy electric cars that nobody else wanted (that he knew for months I was going to do!), and he just went CRAZY," wrote Trump on the Truth Social platform on Thursday.

Bitcoin risks a crash to $92,500 if it fails to recover $103,000 support

The rhetorics between Trump and Musk amplified bearish sentiment in the market, sending Bitcoin below the $103,000 support level on Thursday. The top crypto bounced off the 50-day Simple Moving Average (SMA) but is down 3%, trading at $101,800 at the time of publication.

BTC/USDT daily chart

The decline quickly triggered $337.27 million in BTC futures liquidations. Long traders felt the heat of the pullback, seeing liquidations of $308 million, while short liquidations were barely above $29 million.

If selling pressures continue to mount, BTC could move toward $92,500, a potential stronger support level strengthened by the 100-day SMA. However, if Bitcoin breaks below this level, it could signal a deeper market correction.

The Stochastic Oscillator (Stoch) is in the oversold region, indicating strong bearish pressure but with chances of a recovery.

Content Original Link:

" target="_blank">