3 Reasons the Bitcoin Price Is Stuck, Despite the Surge in Treasury Companies

Over the past few weeks, the crypto world has been buzzing with announcements from a new breed of publicly traded companies — crypto treasury firms. These businesses exist primarily to raise capital and buy crypto, largely Bitcoin, for their balance sheets. Since the start of April, they’ve collectively raised an estimated$11.3 billion, with the bulk earmarked for Bitcoin.

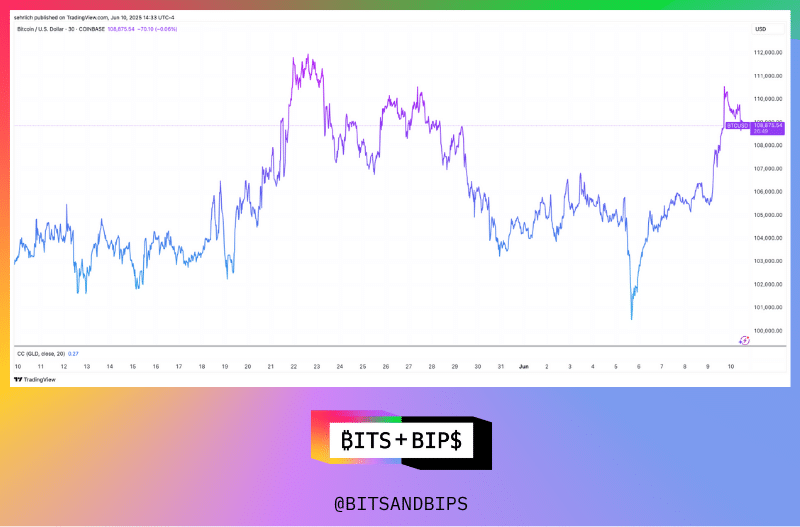

Hype for crypto’s newest fad is reaching a fever pitch, but curiously, the price of bitcoin has struggled to follow suit. The token is just a hair away from its all-time high of $111,814, but over the past month or so, the price has been stuck between $100,000 and $110,000 (as of press time, bitcoin is priced at $108,855).

If these billions of dollars are on the way, especially with such a pro-bitcoin administration, one might think that the asset is ready to take the next leap forward. Not so, say a number of experts interviewed for this story and, in fact, it may take a while for the asset to make its march toward $130,000-$150,000.

Here are a few reasons why bitcoin is not ready to climb its next hill.

Retail Investors Aren’t Biting

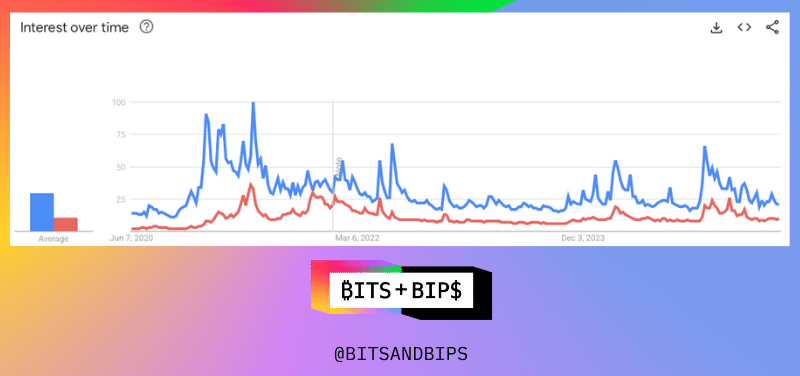

Past hype cycles in crypto, even if they ultimately collapse, are punctuated by intense retail interest. Take a look at the following Google Trends chart, showing searches for the word “bitcoin” in blue and searches for “crypto” in red. A lot of attention was given during COVID and then again through the latter half of 2024, when President Trump went full crypto. However, those numbers have again declined and they are going down even further.

Crypto Interest is Dwindling: Bitcoin (blue line), Crypto (red line)

Why is retail not enthused? Plenty of reasons: from a belief that after setting an all-time high bitcoin is perhaps now poised to retrace, to a lack of understanding of how crypto treasury companies operate and could be profitable investments.

The NFT and memecoin crazes captured popular attention in a way that a leveraged publicly traded hedge fund simply cannot. Remember in 2021 when Pete Davidson and Jack Harlow starred in an SNL skit about NFTs? And how many celebrities launched memecoins in 2024?

Steve Sosnick, chief strategist at Interactive Brokers, said, “I do think that these treasury companies are beneficial to the price of bitcoin because they’re a source of demand, and they take these coins out of circulation to some extent. So in theory, it’s a boon to the price. Why it’s not a bigger boon is hard to say. It does make you wonder if demand outside of these companies is ebbing a little bit.”

Liquidity Is Being Recycled, Not Added

The demand question may be even more complicated.

Those of you who have been in crypto long enough may remember the term “vampire attack,” which refers to a specific strategy from the DEX SushiSwap to siphon liquidity from its main competitor, Uniswap. But something similar is happening here as well. According to the head of trading at one prime broker, whose clients are trading both bitcoin and shares in these treasury companies, many investors in these new firms are selling their bitcoin for liquidity to buy shares. Put another way, not as much new money as you may think is actually coming into the sector.

“You’re actually sucking liquidity out of the market. Let’s give a vanilla case. I’m contributing a billion dollars of bitcoin to a corporate treasury. The money that is being spent by people purchasing [those coins] isn’t actually flowing into Bitcoin. It’s flowing into yesterday’s Bitcoin. And so the market impact has already been felt,” says the head of trading.

Hype Now, Pay Later

Another reason for the sluggishness is that despite the hype train and sticker shock of these announcements, it does not mean that any new bitcoin is being bought right away. Take Nakamoto, a crypto treasury company founded by Bitcoin Magazine’s David Bailey, which raised over $700 million to fund bitcoin purchases. Do you know how much bitcoin the company holds today? Just $2.3 million, as the transaction is still waiting to close, likely in Q3.

And this speaks to a bigger challenge with deducing the buying activities of these companies. They are very opaque. Said the trader, “When you see that MicroStrategy is raising a billion with their ATM [at the market stock offering], you know that they’re going out and purchasing a billion dollars’ worth of bitcoin. The ETFs are the easiest because they literally report sometime after the close what their flows were that day or potentially one day in arrears. When you have a really large inflow day, you will often see a bit of a positive effect on the market during that period.”

But when it comes to these corporate treasury companies, it is much more opaque. “Some of them are announcing that the deal won’t close for three months,” he said. “While the bankers are talking about the deal, the market doesn’t know when [the crypto] is getting purchased, and so it’s a lot harder for it to see what the effect is.”

The Bottom Line: Bitcoin Needs Another Catalyst

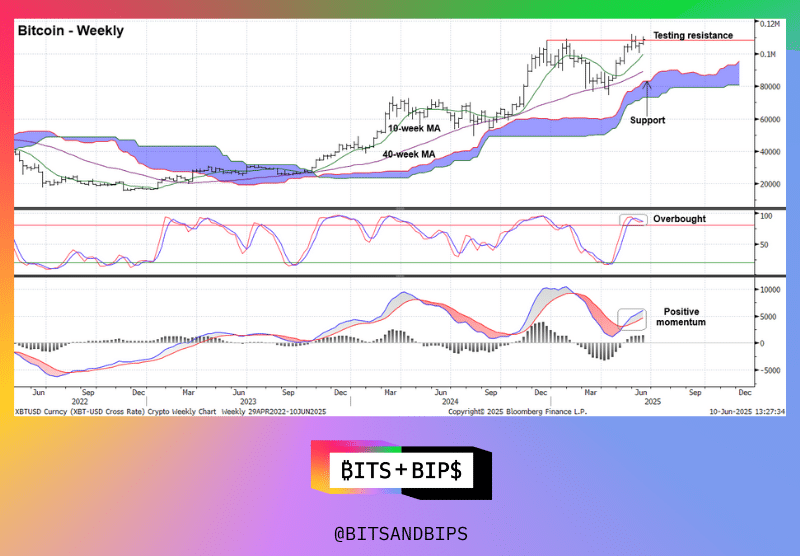

Given the crypto treasury fad’s fundamental failure creating a new buying catalyst, at least so far, it appears that the industry will need another stimulus to move ahead. Looking at the technical charts, Katie Stockton, the founder and managing partner of Fairlead Strategies, said, “From a short-term perspective, [bitcoin’s] been sort of bound between about $100,000 and this resistance [$108,000] for more than a few weeks. Our view is that the resistance is more likely to stay intact, meaning we won’t see a decisive breakout, and that’s because we have overbought conditions across timeframes.”

In her comments to Unchained, Stockton pointed out that bitcoin’s 50-day moving average is a key support line to be watched (see chart below), and it would take “a couple weeks above that $108,000-$109,000 resistance to allow for that kind of upside objective. But until we have that decisive breakout, we’re not buyers of bitcoin because we think there’s risk of a retracement within what could be unfolding as a trading range environment.”

The prime broker also echoed Stockton’s views, saying, “the overall range of Bitcoin has been in a very tough to trade place. Most of our clients have expressed discontent with trying to play this range because the idea is we are heading into what is historically a low volatility and low liquidity period in the summer.”

It looks like bitcoin is going to be stuck for a little while longer.

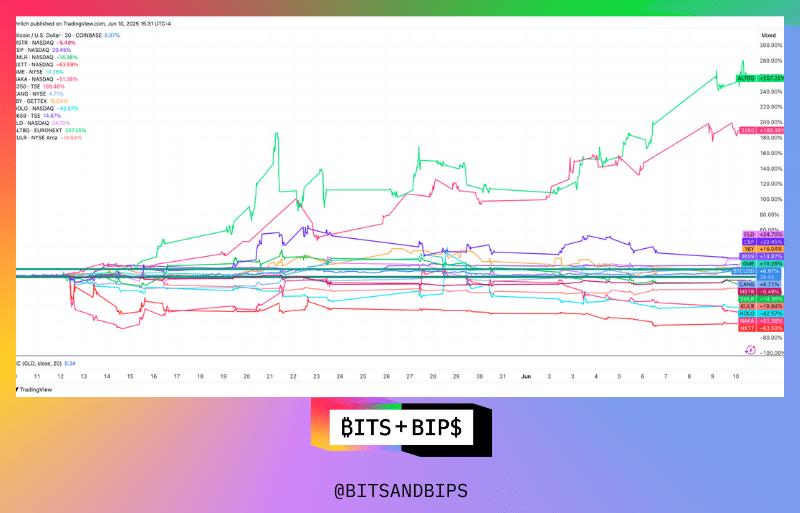

Chart of the Week: 1-Month Treasury Company Performance Versus Bitcoin (min $100 million in Bitcoin)

Not every crypto treasury company is a screaming buy. In fact, bitcoin has outperformed almost half of the most valuable crypto treasury companies over the past month. Nevertheless, all of them are still trading at positive premiums to NAV.

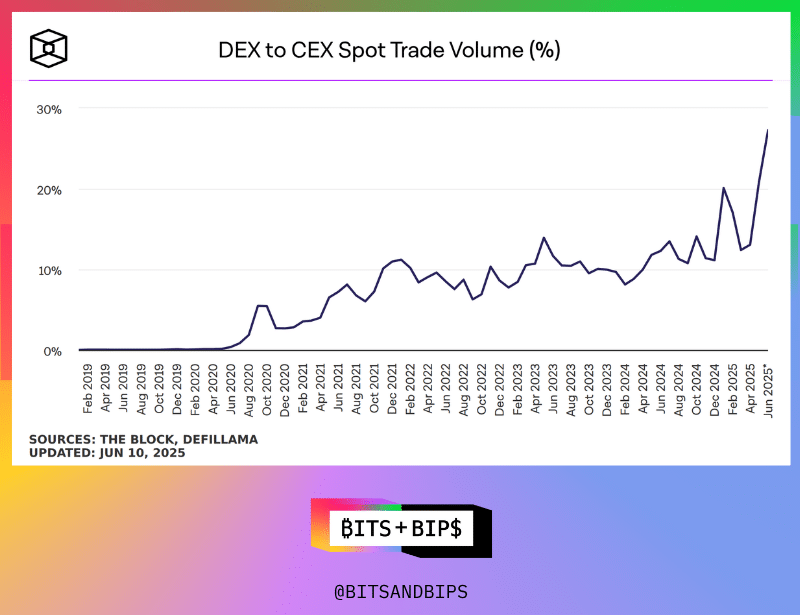

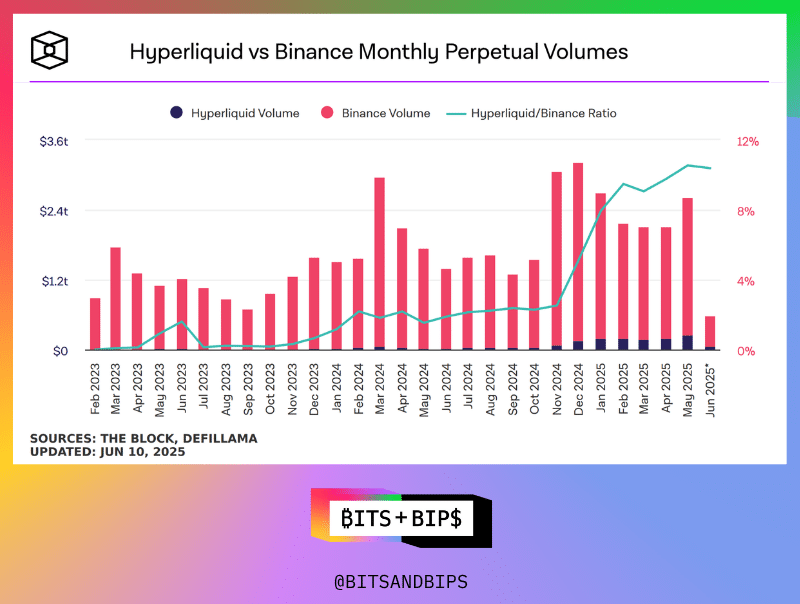

Number of the Week: 27.26%

The ratio of DEX trading volume to their CEX counterparts reached an all-time high of 27.26%. Most of this growth has come from the derivatives exchange Hyperliquid, whose rapid growth has grown to its own record high of 10.38%.

Content Original Link:

" target="_blank">