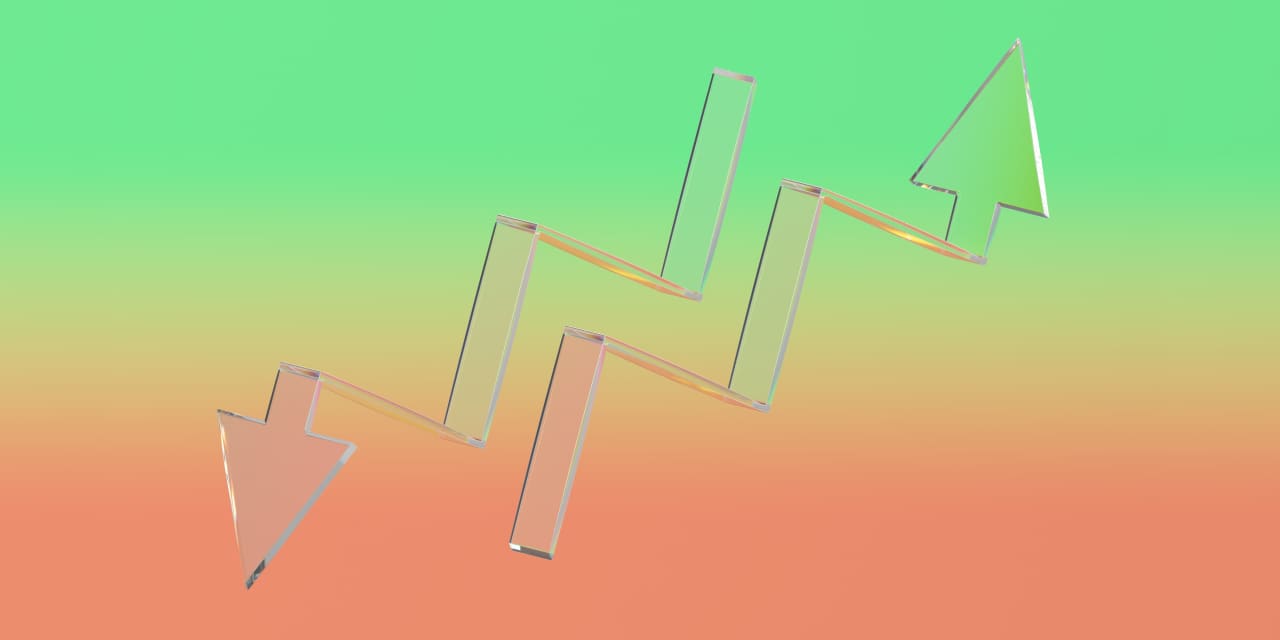

Bitcoin Price Surges 28% as Metaplanet Adds $93M BTC — Analysts Eye $111K as Strategic Buy Zone

Bitcoin (BTC) surged 28% in July, reaching highs near $123,200, fueled by growing institutional adoption and strategic accumulation.

Tokyo-listed Metaplanet led the charge, purchasing 780 BTC worth $93 million, bringing its total holdings to 17,132 BTC valued at $1.7 billion. The firm aims to acquire 1% of Bitcoin’s total supply, 210,000 BTC, by 2027, signaling aggressive long-term confidence.

Despite Bitcoin’s rally, Metaplanet’s stock fell 40% year-to-date due to valuation concerns and investor profit-taking. Nonetheless, this divergence reflects a broader shift, with Japanese firms increasingly adopting Bitcoin as a reserve asset.

Analysts suggest that Metaplanet’s strategy could shape institutional treasury models in volatile macroeconomic conditions.

$111,500: Bitcoin’s New Strategic Buy Zone

Technical analysts now view the $111,500 level as a key support zone, marking a significant resistance-turned-support flip. Markus Thielen of Matrixport highlights this level as a strategic entry point for investors.

A confirmed bounce could propel BTC toward a breakout above $120,000, pushing a bullish momentum. Consequently, traders are advised to watch for strong volume confirmation around $111K, employing staggered entries and tight stop-losses.

While dips below $112K may present buying opportunities, a sustained decline would require reassessment of risk. The level’s psychological significance aligns with historical resistance flips that often precede long-term rallies.

Altcoin-Focused Funds Suffer as BTC Dominates

While Bitcoin thrives, altcoin-heavy liquid crypto funds have seen dramatic losses. Asymmetric Capital’s Liquid Alpha Fund collapsed by 78% despite Bitcoin’s gains, due to overexposure to speculative altcoins and excessive leverage.

Institutional capital is now favoring utility-driven, revenue-generating projects over memecoins. Experts like Rajiv Patel-O’Connor emphasize that future crypto investments must meet stricter criteria; liquidity, transparency, and token utility.

As Bitcoin continues to cement its role as a digital reserve asset, the market is clearly pivoting toward sustainable fundamentals.

Bottom Line

Bitcoin’s rally, especially with the institutional momentum and technical bullish signals, marks a pivotal moment for crypto markets. The $111,500 zone could be a rare opportunity for savvy investors seeking structured entry amid broader altcoin turmoil.

Cover image from ChatGPT, BTCUSD chart from Tradingview

Content Original Link:

" target="_blank">