4 June 2025 13:06 GMT Updated 4 June 2025 13:06 GMT

By Andy Pierce in Oslo

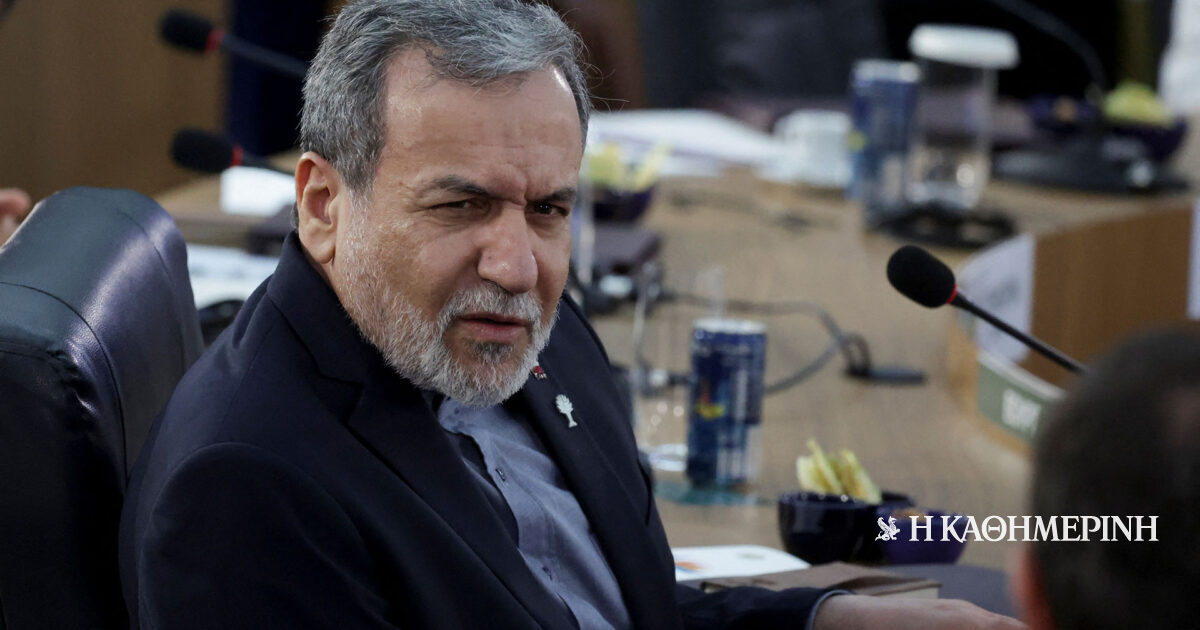

Greek shipowner

4 June 2025 13:06 GMT Updated 4 June 2025 13:06 GMT

By Andy Pierce in Oslo

Greek shipowner Evangelos Marinakis has expressed his disappointment at the premiums on offer for new vessels with advanced fuel solutions.

Marinakis was one of the leading investors in new fuel technologies during the past few years as he amassed one of the largest orderbooks in the industry.

Speaking at Nor-Shipping today, Marinakis said he signed the orders at a time everyone from oil majors to classification societies was optimistic about greener fuels.

This encouraged the tycoon to inject some of his profit from previous cycles back into the industry.

Marinakis said this focus on future fuel technology added an extra $15m to $30m per ship on his relevant newbuildings.

“So far, to be honest, we have been extremely disappointed because we don’t see anyone paying,” he told the TradeWinds Shipowners Forum.

“When you build a vessel for the next 15 or 20 years, you think that in two, or three, or four years time you will realise a premium.

“On the other hand, if you can afford to wait, and you have your cash reserves to wait and survive in case things go wrong – plus you have paid premiums that you don’t get paid for it, I think that’s a matter of time.”

Marinakis continued: “I’m still optimistic, but of course, at the beginning, I was more optimistic.

“I think it’s a matter of time and, of course, with the Trump administration, this might go further down the line. But again, we are there for the long term, not just the next three years.”

Marinakis said he had also ordered some traditionally fuelled ships, including feeder vessels and VLCCs, to balance the books. Further conventional orders were also a possibility, he said.

In a one-on-one interview with TradeWinds editor-in-chief Julian Bray, Marinakis said he was disappointed with new IMO proposals, that will cut short the effectiveness of LNG fuel ships in the 2030s.

“For us, LNG-fuelled is a bet. But it is a bet where we need to be patient. We did not expect it, but there is a significant premium we will be getting, and you can’t have it all, so we are relaxed about it.”

Marinakis was pressed on whether he would order newbuildings in China today, given US policy designed to erode its position as the world’s leading shipbuilder.

“We would think twice if we were to go ahead with newbuildings or not,” Marinakis replied.

“But I would not think twice if it’s China or Korea. We have relations for many, many years with both countries and the yards there.

“My personal opinions as far as the tariffs are concerned, I think it’s a matter of time and everything will stabilise within this year.

“Of course, there will be some tensions, some hard negotiations, some extra measures, some announcements.

“But at the end of the day, I think this creates opportunities. If you are there and in front of the competition, you can take advantage of all this and it makes our business even more exciting.”

Marinakis spoke of the benefits of being a diversified shipowner of significant scale rather than focusing on one space.

“When you are in the market and you have experience in various sectors, it helps a lot,” he said.

“It is a very rare occasion when we have all markets not performing or all markets performing.”

Opportunities came up in different markets at different times, Marinakis said.

“Sometimes, when it is a big company, we can provide a number of ships to a charterer, we can negotiate with yards, and it gives us an extra advantage to get a better price or get a better charter,” he explained.

“From the start of the year, everyone is very nervous about tariffs and this tension, but we have done over 300 years of time charter.

“It is good to say everyone is cautious. At the same time, there is business there and I can say we enjoy it.”

Content Original Link:

" target="_blank">