How the Smart Money Flies With Southwest Airlines (LUV) Stock Options

LUV Stock Sequence Presents Probabilistic Opportunity

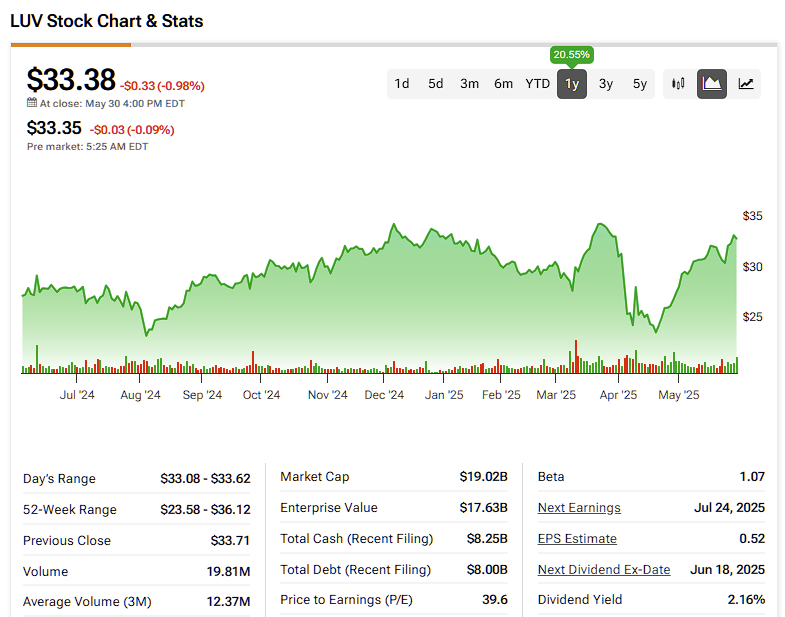

Regarding LUV stock, over the past two months, the security printed a “6-4-D” market breadth sequence: six up weeks, four down weeks, with a net negative trajectory across the 10-week period. Using an AI-based algorithm, I’m able to determine that this sequence occurred 48 times in the trailing 10 years.

More importantly, in nearly 67% of cases, the following week’s price action results in upside, with a median return of 3.19%. Given that LUV stock closed at $33.38 on Friday, if the 6-4-D pattern’s implications pan out as projected, the security may hit $34.44 in short order, perhaps within a week or two. If the bulls maintain control of the market, a push above $35 wouldn’t be unreasonable.

What makes the above setup so compelling is that, as a baseline, LUV barely features a positive bias. On any given week, the chance that a long position will be profitable is only 51.2%. That’s calculated by taking the number of positive weeks divided by the total number of weeks in the dataset.

Basically, the 6-4-D sequence improves the odds from a coin toss to a 67/33 wager in favor of the bullish speculator. If you’re a numbers person, you’re incentivized to take a shot here.

An Aggressive But Rational Wager

Those interested in rolling the dice may consider buying the 33.50/35 bull call spread expiring June 20. This transaction involves purchasing the $33.50 call and subsequently selling the $35 call, for a net debit paid of $66. Should LUV stock rise through the short strike price at expiration, the maximum reward is $84, a payout of over 127%.

Fair warning, this trade will be tight. Based on prior trends, the median positive performance from the 6-4-D sequence will have LUV stock trading around $34.70. That’s more than enough to exceed the aforementioned trade’s breakeven price of $34.16. However, it does fall a bit short of the $35 target.

Granted, median performance also means that LUV stock can perform better than expected or worse. The risk here is multi-dimensional. While the chance of upside is higher, the magnitude of upside represents more of a guessing game.

What could break the deadlock is that the $35 level is almost certainly a psychologically significant price target. Therefore, it wouldn’t be surprising for the bulls to attempt to push toward that level, making the 33.50/35 bull spread attractive.

Is it a Good Time to Buy Southwest Airlines Stock?

Turning to Wall Street, LUV stock carries a Hold consensus rating based on six Buys, seven Holds, and four Sell ratings acquired over the past three months. The average LUV price target is $31.38, implying almost 6% downside risk over the next twelve months.

LUV Stock Offers a Hot Hand

Southwest Airlines is emerging as an increasingly compelling investment opportunity. For traders focused on shorter-term gains, however, LUV stock may be even more attractive in the near term. While its baseline probability of upside performance is only modestly above average, current market breadth indicators point to a potential strengthening trend. Given these signals, bullish investors may find added incentive to initiate a position.

Content Original Link:

" target="_blank">