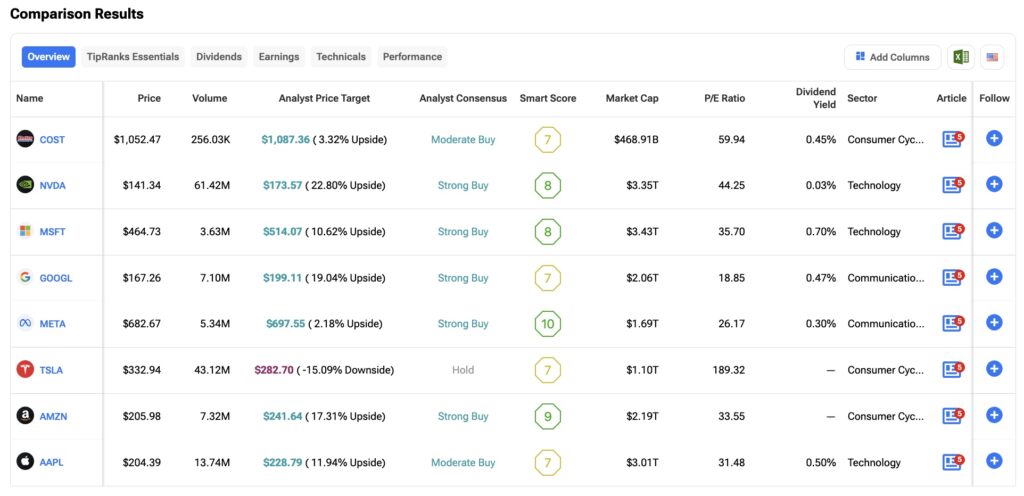

Why Costco Stock (COST) May Be a Smarter Investment Than Big Tech

In the most recent quarter, membership income rose 10% year-over-year, with a staggering 93% renewal rate in North America. That kind of brand loyalty and perceived value creates a business model with very little risk of earnings volatility. And because of that, Costco functions like a defensive stock, offering low risk and a high degree of predictability in returns. So, while the valuation may look stretched on the surface, this level of stability and cash flow certainty arguably justifies a premium multiple.

When Tough Times Hit, Costco Gets Tougher

While only about 2% of Costco’s total revenue comes from membership fees, those fees account for more than half of the company’s total operating income. At this kind of scale, there’s simply no other retailer that can pull off a high-volume, low-margin model quite like the Issaquah, Washington-based warehouse giant. Main Street Data indicates that Costco’s revenues are inching higher while membership fees remain a staple.

That’s why, even during periods of weak consumer spending, Costco tends to remain highly profitable—not just because of its membership model, but because it consistently gains market share from competitors. By keeping margins razor-thin on discretionary items, and with shoppers naturally shifting toward essentials during times of financial stress, Costco puts pressure on rival retailers that simply can’t match its pricing without cutting into their own profitability.

Take Q3, for example: Costco’s comparable sales rose 8% year-over-year to $62 billion, while peers like Target (TGT) saw comparable sales shrink and were forced to revise earnings guidance downward. This highlights how Costco isn’t just weathering macroeconomic headwinds—it’s actually growing through them. In other words, macro risks seem to have a much lighter impact on a company like Costco.

The Fine Line Between Fair Price and Overpaying

While Costco’s relatively low-risk business model may warrant a valuation premium, it’s worth exploring what an appropriate stock price might look like under simplified assumptions.

For this analysis, I’ll estimate an equity value for Costco using a basic perpetuity-based discounted cash flow (DCF) model. Let’s begin with the fact that, in fiscal year 2024, Costco generated approximately $4.8 billion in membership fee revenue. While this isn’t equivalent to free cash flow, it serves as a reasonable proxy for recurring operating cash flow due to its stable and high-margin nature.

With Costco’s current market capitalization at approximately $470 billion, we can reverse-engineer the valuation. If we assume a 6% discount rate—reflecting the company’s relatively low risk profile despite the 10-year Treasury yield sitting around 4.4%—and a perpetual growth rate of 5%, the implied equity value is approximately $480 billion, or about $1,083 per share. This closely aligns with Costco’s current share price.

These assumptions appear fairly reasonable and suggest that Costco’s valuation is justified under optimistic, yet not unrealistic, conditions. However, using a more conservative 7% discount rate, while keeping other assumptions constant, would cut the implied equity value significantly, roughly in half.

In summary, while Costco does not appear overvalued under favorable scenarios, the current valuation leaves little room for error. A meaningful margin of safety may only emerge if macroeconomic conditions shift, such as a recession prompting lower risk-free rates and, in turn, greater tolerance for elevated valuation multiples.

Is Costco a Good Stock to Buy?

Out of the 25 analysts who have covered COST in the past three months, 17 rate the stock as a Buy, while the remaining eight call it a Hold. So, while the overall sentiment is moderately bullish, the average price target of $1,096.36 implies ~8.5% upside from the current share price over the next twelve months.

Cautious Optimism for the Warehouse Giant

Given the strength and stability of Costco’s underlying business model, its premium valuation multiples appear justifiable. At present, there are no significant concerns that would challenge a constructive outlook on the stock. However, it’s important to note that the current valuation offers limited—if any—margin of safety.

As such, I maintain a cautious Buy rating on Costco. While near-term upside may be constrained, the company remains well-positioned to deliver steady, long-term compound growth.

Content Original Link:

" target="_blank">