ACM Research, Inc. (ACMR):

We came across a bullish thesis on ACM Research, Inc. on Stock Analysis Compilation’s Substack. In this article, we will summarize the bulls’ thesis on ACMR. ACM Research, Inc.'s share was trading at $29.60 as of June 22nd. ACMR’s trailing and forward P/E were 18.85 and 14.79, respectively according to Yahoo Finance.

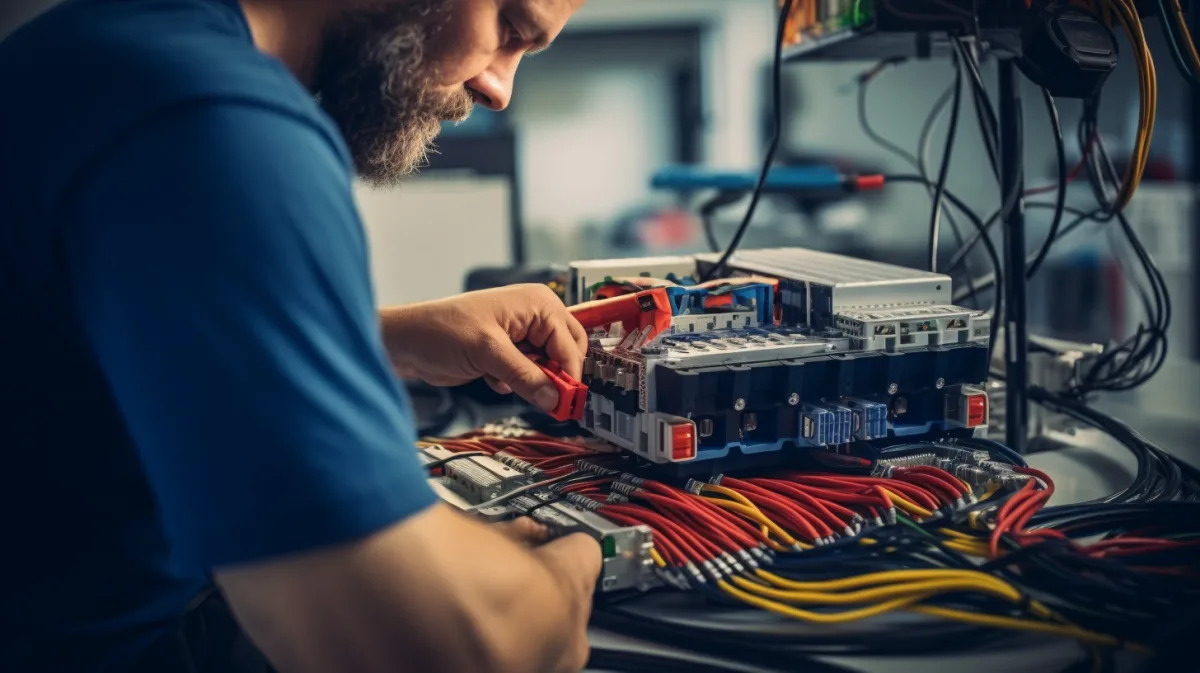

ACM Research (ACMR), a leading Chinese semiconductor wafer cleaning equipment manufacturer, is positioned to benefit significantly from China’s accelerated push for semiconductor supply chain localization amid intensifying trade and geopolitical tensions with the U.S. China, which consumes 35% of the world’s semiconductors but produces only 7% domestically, is rapidly building self-sufficiency, creating an enormous tailwind for domestic players like ACMR.

The Chinese wafer fabrication equipment (WFE) market is approximately $35 billion, growing at 7.5% annually, with the cleaning segment valued at $2 billion. ACMR currently holds a 14% share, behind international leaders Tokyo Electron and Lam Research, but foreign competitors are quickly losing ground. A projected share gain to 25% by 2030 represents an incremental $7 billion in revenue, supported by ACMR’s proven track record of 20%+ topline CAGR over the past decade and 2024 growth rates three times that of Western peers.

Despite its dominant domestic positioning and strong growth profile, ACMR trades at a substantial discount to both Chinese and Western peers. Structurally, ACMR is a Delaware-incorporated holding company that owns 83% of ACM Research Shanghai (SHA: 688082), whose shares trade at over a 250% premium, offering a “free call option” should management take steps to close the valuation gap.

This unique structure shields ACMR from potential U.S. delisting risks while providing direct exposure to China’s secular fab buildout and market share gains. Overall, ACMR offers an asymmetric opportunity combining explosive growth potential, valuation arbitrage, and a protected U.S. listing that could drive substantial upside for investors.

Previously, we covered a bullish thesis on ACM Research, Inc. (ACMR) by thexcapitalist in April 2025, which highlighted strong revenue growth, exposure to China’s semiconductor localization, and a discounted valuation despite geopolitical risks. The company’s stock has appreciated about 61% as the thesis played out. The thesis still stands. Stock Analysis Compilation shares a similar view, emphasizing valuation arbitrage via ACM Shanghai and asymmetric upside.

ACM Research, Inc. is not on our list of the 30 Most Popular Stocks Among Hedge Funds. As per our database, 32 hedge fund portfolios held ACMR at the end of the first quarter which was 23 in the previous quarter. While we acknowledge the potential of ACMR as an investment, we believe certain AI stocks offer greater upside potential and carry less downside risk. If you're looking for an extremely undervalued AI stock that also stands to benefit significantly from Trump-era tariffs and the onshoring trend, see our free report on the best short-term AI stock.

Content Original Link:

" target="_blank">