Why Is Crypto Going Up? Bitcoin, Ethereum, XRP & Dogecoin Prices Are Rising Today

Retail traders are once again asking, why is crypto going up today? The answer is a potent mix of macroeconomic shifts, renewed institutional inflows, and technical momentum. On Tuesday, June 3, 2025, the Bitcoin (BTC) price, Ethereum (ETH) price, XRP price, and Dogecoin (DOGE) price have all staged impressive comebacks, defying global uncertainty and a wave of liquidations.

Bitcoin is holding around $105,000, Ethereum is trending near $2,600, XRP is testing $2.20 resistance, and Dogecoin sets intraday high above $0.20. But is this rally sustainable, or just another head fake?

Let’s break down the current action, key drivers, and the newest price predictions for these top cryptocurrencies, while answering the question: why is crypto going up today?

Bitcoin Price Analysis: Resilience Above $105,000

The Bitcoin price has become a symbol of resilience in early June 2025. After a turbulent weekend that saw nearly $1 billion in liquidations, Bitcoin rebounded sharply, climbing over 3% in just four days and peaking at $106,560 on Tuesday.

Just last Friday, I wrote about four consecutive days of declines for Bitcoin and the broader crypto market. Now, we’re seeing a reversal, four straight days of gains. They may be modest, but they’re gains nonetheless.

At the time of writing, Bitcoin is trading at $105,453. This recovery is largely attributed to continued whale accumulation, as on-chain data reveals that large holders are buying the dip, a classic bullish signal that often precedes further gains.

Why is Bitcoin price going up today. Source: Tradingview.com

On the macro front, geopolitical tensions and looming policy deadlines are driving traders toward Bitcoin as a hedge against uncertainty. Despite hints of fatigue in technical indicators, with some analysts warning of a possible cooling-off period, Bitcoin’s elevated trading volumes and persistent interest have kept it at the top of the crypto pecking order.

According to my technical analysis, I expect Bitcoin to consolidate between $103,000 and $108,000 in the short term, with $100,000 acting as a critical support level. If this support fails, downside targets near $97,000–$93,000 may come into play.

On the upside, forecasts for June 2025 suggest a potential high of $137K, with some long-term models predicting Bitcoin could reach even $400,000 by 2030.

Options traders are betting on wild moves, with some eyeing a $300,000 Bitcoin by late June, but most experts see $120,000–$137,000 as more realistic near-term targets.

Ethereum Price: Bullish Momentum, But Resistance Looms

Ethereum price has been riding a wave of optimism, surging over 7% since Saturday and testing $2,650.83 before settling near $2,615.89 at press time. This rally has been fueled by internal restructuring at the Ethereum Foundation and growing excitement over upcoming protocol upgrades. The Foundation’s renewed focus on protocol development has injected fresh energy into the Ethereum ecosystem, attracting both institutional and retail interest.

Why is Ethereum price going up today. Source: Tradingview.com

Speculation around a possible Ethereum ETF approval has also played a significant role in driving demand, as traders anticipate a flood of new capital entering the market. Technically, Ethereum is trading above key moving averages, with momentum indicators suggesting further upside if the price can decisively break above the $2,810 resistance level.

However, repeated rejections and long upper wicks around this area indicate some hesitation among traders. If bullish momentum revives, analysts expect Ethereum to reclaim the $2,800–$2,900 zone in June 2025.

Looking further ahead, some bold predictions see Ethereum reaching $11K, but the consensus among experts is a range of $3,000–$6,500.

XRP Price: Ready for a Breakout?

XRP price is quietly building pressure, consolidating above $2.19 after bouncing nearly 7% from weekend lows. The token hit an intraday high of $2,2229 on Tuesday, marking four consecutive days of gains. What’s driving this move is a surge in speculative activity, as open interest in XRP derivatives has ballooned to nearly $5 billion. This intense positioning suggests that traders are bracing for a decisive move, with the potential for a short squeeze if bullish momentum takes hold.

Why is XRP price going up today. Source: Tradingview.com

Historically, similar setups in XRP have resulted in rapid rallies, catching short sellers off guard and triggering sharp price spikes. However, the direction of the next big move remains uncertain, as elevated open interest can also amplify volatility in either direction.

Without a clear catalyst, such as a major development on the XRP Ledger or news of an ETF approval, traders are at risk of large-scale liquidations if sentiment turns sour. Some analysts predict a possible surge to $8 if key catalysts align, though this is considered highly speculative. For now, the market is closely watching for any fundamental news that could trigger the next breakout.

Dogecoin Price Is Going Up: Volatility Returns

Dogecoin price is once again in the spotlight, testing an intraday high of $0.2013 after three straight sessions of gains. DOGE is currently trading at $0.1961, up nearly 3% from the weekend levels. This latest rally is part of a broader market rotation, as traders often move profits from Bitcoin and Ethereum into meme coins like Dogecoin when the majors are rallying. The technical setup is also supportive, with expanding Bollinger Bands hinting at the potential for a larger move.

Why is Dogecoin price going up today. Source: Tradingview.com

Dogecoin’s price action is notoriously volatile, with sharp swings driven by both retail enthusiasm and sudden shifts in sentiment. Forecasts for the summer months suggest Dogecoin could hover between $0.191 and $0.223, with upside capped unless the $0.2310 resistance is reclaimed. If DOGE can break and hold above $0.2100, a run toward $0.2310 is on the table. Conversely, failure to hold $0.1900 could see a slide toward $0.17.

As always, Dogecoin remains a high-risk, high-reward play, favored by traders looking for quick gains.

Why Is Crypto Up Today? Key Drivers for June 2025

So, why is crypto up across the board? The rally is being driven by a combination of institutional adoption, macroeconomic events, ETF speculation, technical momentum, and network upgrades.

- Institutional Adoption - Large financial institutions, hedge funds, and public companies are investing heavily in Bitcoin, Ethereum, and other cryptocurrencies. This influx of institutional capital not only boosts demand but also lends legitimacy to the market, attracting even more participants and driving prices higher.

- ETF Approvals and Mainstream Integration - The approval and rapid growth of spot Bitcoin and Ethereum ETFs have made it easier for both retail and institutional investors to gain exposure to crypto. These ETFs have seen record inflows, with products like BlackRock’s Bitcoin ETF becoming the fastest-growing in history. This mainstream integration has significantly increased demand and price stability.

- Regulatory Clarity - Clearer regulations in the US, EU, and Asia, such as the EU’s MiCA framework and pro-crypto policies from the Trump administratios, have reduced uncertainty and boosted investor confidence. Regulatory advancements, including the rescinding of restrictive rules and the appointment of crypto-friendly officials, are making the environment more attractive for investment.

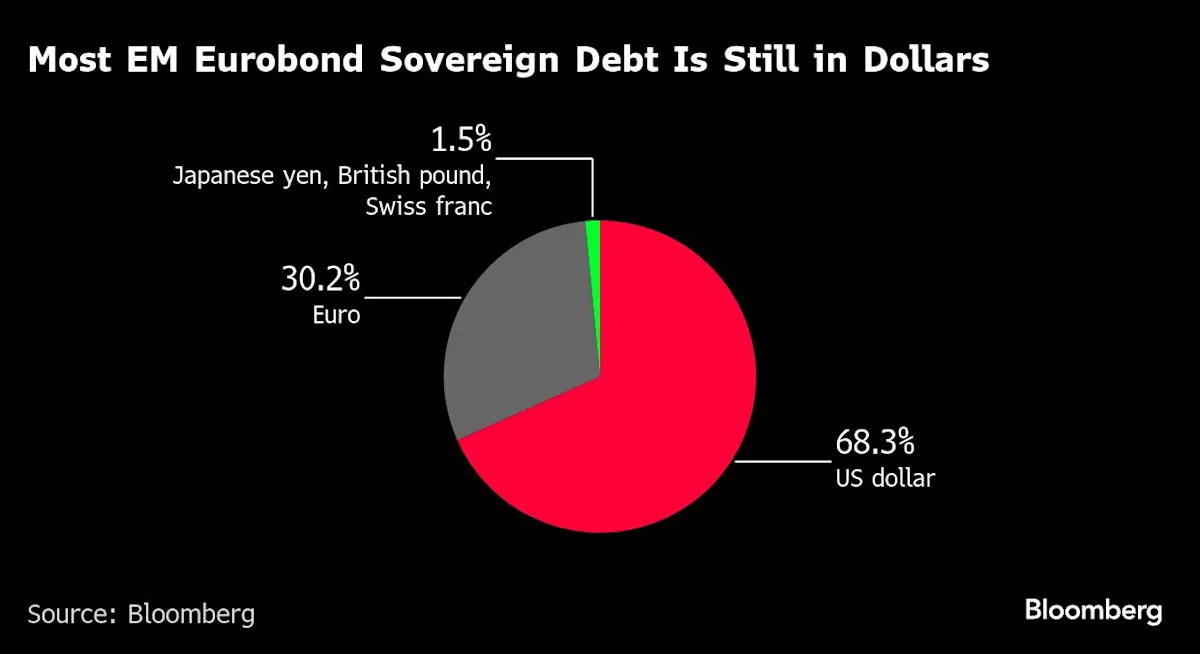

- Global Economic Factors - Concerns over inflation, currency devaluation, and uncertain monetary policies are prompting investors to view crypto as a hedge and a store of value. Rising debt levels and macroeconomic instability are pushing both individuals and institutions toward digital assets.

Crypto Market Outlook and Price Predictions 2025

The crypto market in 2025 is defined by strong momentum, institutional inflows, and bullish sentiment, with Bitcoin, Ethereum, and XRP all in the spotlight for their technical setups and headline-grabbing forecasts.

The consensus among major financial institutions and crypto experts is that Bitcoin could reach anywhere from $120,000 to $200,000 by the end of 2025, with Standard Chartered projecting a potential $200,000 and VanEck suggesting a cycle apex near $180,000. More conservative models see an average year-end price around $135,000, while the most bullish forecasts eye $250,000 if demand outpaces supply

Looking ahead, conservative estimates for Ethereum in 2025 range from $4,900 to $5,950, with some aggressive forecasts suggesting a potential rally to $12,000 if institutional adoption and network upgrades accelerate. The derivatives market is also signaling bullish sentiment, with call options overwhelmingly outnumbering puts and open interest at all-time highs. This technical and fundamental setup suggests Ethereum could outpace Bitcoin in percentage gains if current trends persist.

Several experts now predict that XRP could reach $4.50 by mid-2025, with some calling for a conservative $8–$10 price target by year-end if ETF approval and institutional adoption materialize. The most bullish scenarios, driven by a potential U.S. spot XRP ETF and a shrinking circulating supply, see XRP’s price possibly surging to $17 or even $25–$26 in the coming years if its market cap approaches $1 trillion or more.

Crypto 2025 Price Predictions Table

|

Cryptocurrency |

2025 Conservative Target |

2025 Bullish Target |

2030 Long-Term Target |

|

Bitcoin |

$120,000–$135,000 |

$180,000–$250,000 |

$450,000–$1,000,000 |

|

Ethereum |

$4,900–$5,950 |

$12,000 |

$15,000–$20,000 |

|

XRP |

$4.50–$8 |

$10–$25+ |

$15–$26+ |

The 2025 crypto market outlook is defined by optimism, but also by volatility and the need for traders to monitor key resistance zones and macro catalysts. Institutional flows, ETF approvals, and technical breakouts are likely to set the pace for the rest of the year.

Crypto News, FAQ

Why is crypto rising?

Crypto is rising due to a combination of macroeconomic, institutional, and technical factors. Easing trade tensions between major economies like the US and China have reduced global uncertainty, while downgrades to the US debt rating have pushed investors toward alternative assets such as Bitcoin. Additionally, the US Dollar Index has been trending down, making crypto more attractive as a store of value.

Why crypto went up today?

Today’s crypto rally is being driven by Bitcoin breaking through a new all-time high, which has lifted sentiment across the entire market. The surge is further supported by positive macro developments, such as easing trade tensions and expectations of Federal Reserve rate cuts, which have improved risk appetite.

Can bitcoin reach $200000 in 2025?

Yes, Bitcoin reaching $200,000 in 2025 is considered possible by several leading analysts and institutions. Standard Chartered, Fundstrat, VanEck, and prominent market commentators have all issued forecasts in the $180,000–$250,000 range for 2025, citing factors like institutional adoption, spot ETF inflows, and historical market cycles. Quantitative models, such as the Bitcoin “power law,” also support the possibility of a $200,000 target by late 2025. However, while the outlook is bullish, these projections depend on continued demand, stable macro conditions, and no major regulatory shocks.

Can you make $100 a day with crypto?

It is possible to make $100 a day trading crypto, especially with sufficient starting capital (often $2,500 or more), a disciplined strategy, and a focus on high-volume, volatile coins. Successful traders use techniques like day trading, scalping, and swing trading, combined with strict risk management and stop-losses. However, it’s important to note that consistent daily profits are challenging to maintain due to the crypto market’s inherent volatility and risk.

Content Original Link:

" target="_blank">