Roger Ver's BCH Gambit: Can Bitcoin Cash's Lightning Strike Ignite Mainstream Adoption?

The cryptocurrency space is a battlefield of visionaries, and few have staked their reputation more boldly than Roger Ver—the man once dubbed "Bitcoin Jesus." Today, Ver's latest moves with Bitcoin Cash (BCH) and his ongoing critique of Bitcoin's Lightning Network are sparking heated debates about what it takes to turn crypto into everyday money. Let's dive into the stakes, the strategies, and whether this could be your chance to strike gold—or get burned.

The BCH Blitz: Scaling the "Real Bitcoin"

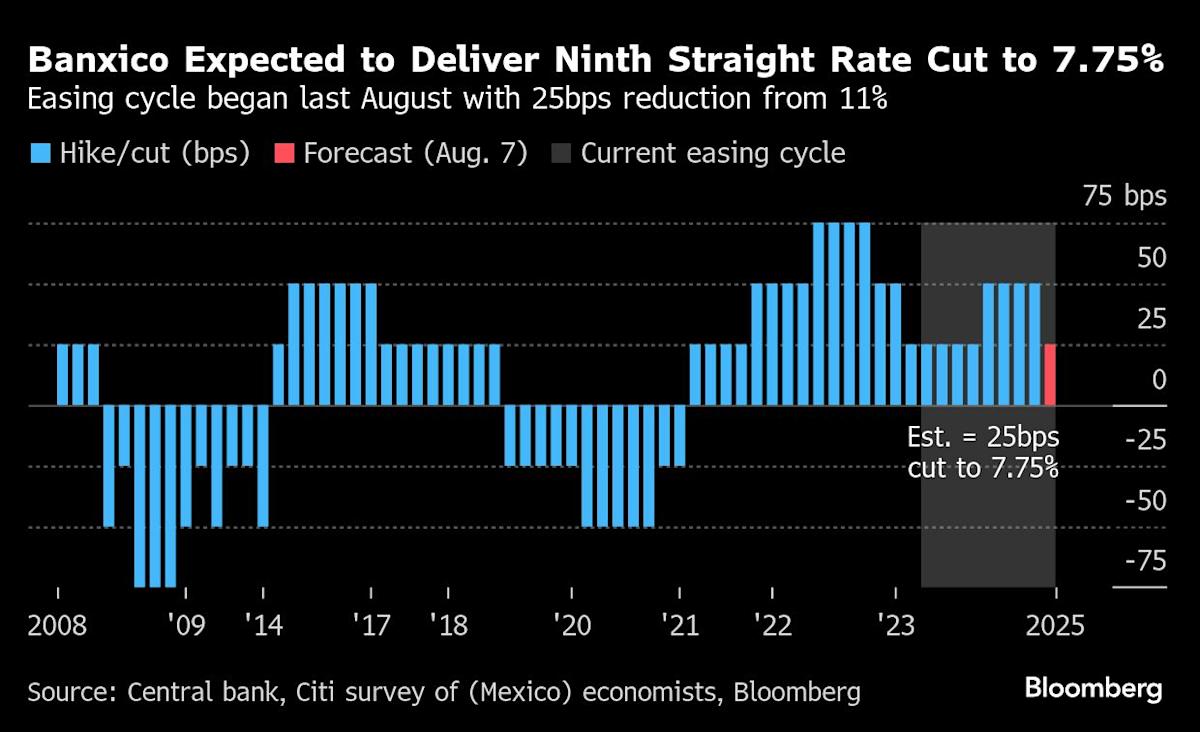

Ver's core thesis is simple: BCH is Bitcoin's true successor. By pushing block sizes to 128MB, he argues, BCH can process transactions faster and cheaper than Bitcoin (BTC), making it viable for everyday use. His team at Bitcoin.com is now doubling down with a CFTC-regulated BCH futures contract, aiming to boost BCH's market cap into the top three cryptocurrencies.

The data shows BCH surged from $250 in April 2025 to nearly $500 by June—a 100% jump—on rumors of the futures launch. Yet volumes remain tiny compared to BTC. Ver's bet? That institutional investors will flock to BCH futures, driving adoption. "This is about making crypto usable, not just a store of value," he told Bloomberg in May.

Lightning Rod: Ver's War on Bitcoin's Layer 2

While Bitcoin's core developers double down on the Lightning Network—a second-layer solution for fast, cheap transactions—Ver calls it "vaporware." His critique? Lightning requires users to manage complex channels and trust third parties, making it too hard for mainstream adoption. "Why build a highway over the existing road when you can just widen the road?" he argued in a 2025 podcast.

Yet the market is split. Bitcoin's Lightning Network now supports over $1 billion in channel capacity, with brands like Steak 'n Shake using it to cut fees. Ver's BCH, meanwhile, sees minimal DeFi activity—its blockchain is used mostly for payments. Investors must ask: Is on-chain scaling (BCH) or off-chain innovation (Lightning) the path to mass adoption?

The Risk Equation: Legal, Regulatory, and Market Volatility

Ver's ventures aren't without red flags. First, his legal troubles: U.S. tax fraud charges loom, and while pardons are speculated, a conviction could destabilize Bitcoin.com's projects. Second, regulatory risks: CFTC oversight of BCH futures is a double-edged sword—legitimacy vs. scrutiny. Third, competition: Ethereum's rollups and Solana's speed are eating into BCH's "scalability" edge.

The data shows BCH's volume lags behind rivals, even during its price rally. Plus, Bitcoin's $100K price in June 2025—up 40% YTD—suggests investors still favor BTC as the "digital gold," leaving BCH in the altcoin pack.

The Cramer Playbook: How to Bet on Ver's Vision

- The Bull Case (Aggressive): Buy BCH now, especially if futures launch successfully. A $1,000 BCH (doubling from June's $500) isn't crazy if institutions pile in.

- The Balanced Play: Pair BCH with a short on Bitcoin—if Ver's "on-chain scaling" wins, BTC's premium could shrink.

- The Safe Move: Wait for futures to go live (mid-2025) and watch for volume spikes. No volume = no real adoption.

Verdict: Ver's BCH push is a high-risk, high-reward bet. The futures launch could be a catalyst—but without a killer app (like a BCH-powered payments empire), this might be another "almost there" story. Only invest 2-3% of your crypto portfolio here. If you're all-in, you're not an investor—you're a prophet.

In the end, the crypto revolution isn't about block sizes or layers—it's about who can make the tech so simple, your grandma can use it. Until then, keep your risk levels low and your price targets higher. Stay hungry, stay Foolish.

Content Original Link:

" target="_blank">

![ΗΠΑ: Η πυρκαγιά Γκίφορντ στην Καλιφόρνια εξαπλώνεται με ταχύτητα προς την... κάμερα [βίντεο]](https://www.ingr.gr/images/joomgrabber/2025-08/adae404b06.jpeg)