Bitcoin-To-Ethereum Rotation: Genius Move Or FOMO Trap? Here's What The Data Shows

The Bear Case: Too Late to the Party?

However, seasoned crypto veterans are increasingly cautioning that the optimal entry window for this rotation may have already closed. After Ethereum’s 100% surge over the past three months, critics argue that attempting the swap now amounts to “FOMOing” into an already extended move.

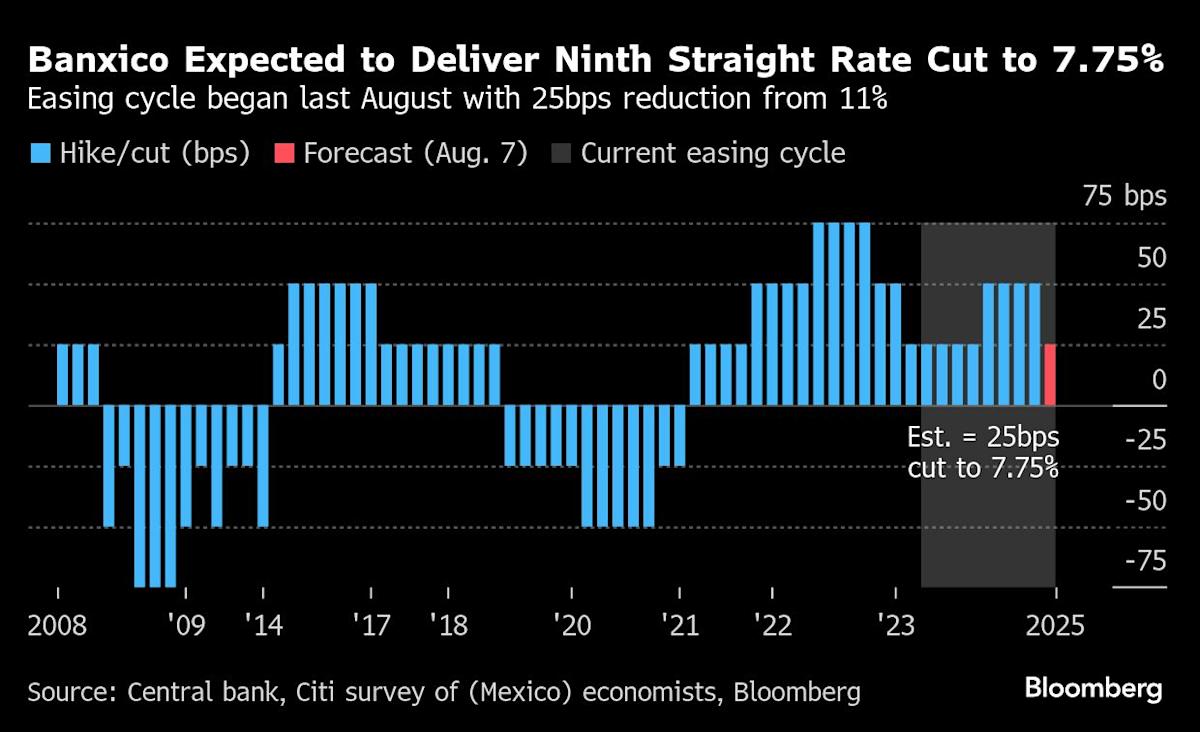

The margin of error for timing the eventual rotation back to Bitcoin has become significantly tighter compared to earlier opportunities when Ethereum traded below $2,000. Bitcoin maximalists maintain that BTC remains the superior long-term store of value, pointing to year-to-date performance where Bitcoin is up 25% compared to Ethereum’s 11% gain.

Market structure concerns add another layer of complexity. The ETH/BTC ratio recently dropped to 0.022, its lowest level since 2020, and some analysts worry that the 2017-style altcoin euphoria that drove massive relative outperformance may not materialize in the current institutional-dominated market environment.

See Also: New to crypto?Get up to $400 in rewards for successfully completing short educational courses and making your first qualifying tradeon Coinbase.

The lending protocol strategy that appeals to tax-sensitive investors carries substantial risks, particularly the possibility of liquidation if Ethereum fails to perform as expected or if Bitcoin experiences an unexpected rally. Given Bitcoin’s tendency for sudden, explosive moves, traders could find themselves “stuck with debt” while watching their collateralized Bitcoin appreciate without them.

The Verdict: Risk Management Over FOMO

For retail investors considering this strategy, the key consideration isn’t whether Ethereum might outperform Bitcoin—it very well could. The critical question is whether the potential gains justify the risks of market timing, tax implications, and the possibility of missing Bitcoin’s continued institutional adoption cycle.

The safest approach may be gradual portfolio rebalancing rather than wholesale rotation, allowing investors to maintain exposure to both assets while managing downside risks. As one seasoned trader noted, “In crypto, permanent capital beats performance chasing.”

Those determined to execute a rotation strategy should consider starting with smaller position sizes and maintaining strict exit rules, remembering that in previous cycles, the window between altcoin peaks and Bitcoin resuming its dominance has often been measured in weeks, not months.

Read Next: A must-have for all crypto enthusiasts: Sign up for the Gemini Credit Card today and earn rewards on Bitcoin Ether, or 60+ other tokens, with every purchase.

Image: Shutterstock

This article Bitcoin-To-Ethereum Rotation: Genius Move Or FOMO Trap? Here's What The Data Shows originally appeared on Benzinga.com

Content Original Link:

" target="_blank">

![ΗΠΑ: Η πυρκαγιά Γκίφορντ στην Καλιφόρνια εξαπλώνεται με ταχύτητα προς την... κάμερα [βίντεο]](https://www.ingr.gr/images/joomgrabber/2025-08/adae404b06.jpeg)