Bitcoin Treasury Companies Are The New Altcoins

Why have altcoins struggled to keep pace with Bitcoin? Because a new set of stars has eclipsed their role this cycle: bitcoin treasury companies.

By “role,” I do not mean their technological utility. I’ve written at length about why different cryptocurrencies exist to serve different use cases, whether enabling stable cross-border value exchange or powering decentralized autonomous organizations.

What I refer to is their market role as speculative, levered proxies for bitcoin - assets that track the original cryptocurrency’s price movements with remarkable accuracy, but with enhanced volatility and risk.

Four years ago, this was conventional wisdom, and indeed how things worked. As Bitcoin appreciated, capital rotated down the risk curve into smaller, less liquid altcoins that could multiply in value much faster from the same amount of money. For some, it was a reason to hardly own Bitcoin at all – and motivation for several projects to launch their own coins in hopes of inheriting some of that risk-seeking capital.

“That’s the bull market. You shouldn’t own bitcoin because it’s gonna underperform,” once said Global Macro Investor CEO Raoul Pal. “And in a bear market, you should own stablecoins. So in which case, why should you ever own bitcoin?”

Pal’s theory hasn’t aged well. Bitcoin dominance – a measure of bitcoin’s market capitalization versus the broader crypto space – remains at a whopping 60%. Ether, the second-largest cryptocurrency, is down 35% against bitcoin over the past year, even though bitcoin has surged 76% against USD during that period. What gives?

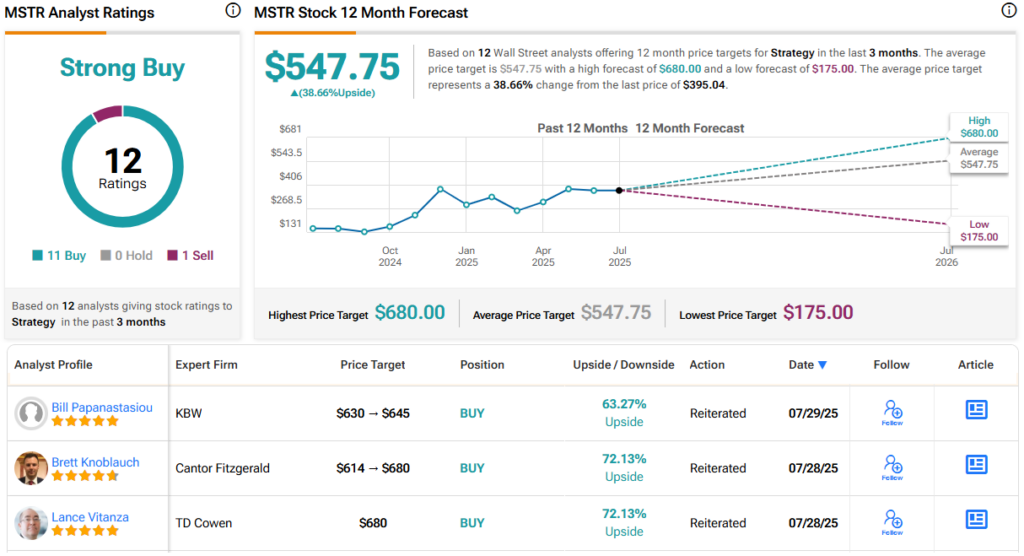

Enter bitcoin treasury companies – a new wave of public equities seeking a far more explicit and truly levered connection to bitcoin’s price. Shares in Strategy (MSTR), the first and largest of such firms, surged over 400% in 2024, outperforming bitcoin, altcoins, and every stock in the S&P500.

Strategy executive chairman Michael Saylor famously went all in on bitcoin in 2020 using the software intelligence company’s dormant cash balance, attempting to protect its assets from currency devaluation. Over time, the company reimagined itself as a “bitcoin bank” seeking a trillion-dollar value by issuing “bitcoin-backed credit instruments” to raise capital and buy bitcoin.

Strategy’s acquisition plan has taken multiple forms: selling stock at a “premium” to NAV to buy more bitcoin, issuing zero-interest convertible bonds, or selling perpetual, dividend-paying preferred stocks that pay above market rates. Altogether, what Strategy offers MSTR investors is exposure to intelligent forms of bitcoin leverage that only a publicly traded company can access, stripped of the liquidation risk and high interest rates that individual investors might otherwise face.

Strategy now owns over 600,000 BTC worth over $70 billion – almost 3% of the entire bitcoin supply.

MetaPlanet (MTPLF), once a Japanese hotel operator, became the first to copy Strategy’s playbook to even greater success. Its stock has exploded over 6000% since announcing its first bitcoin purchase in April 2024, now owning 17,132 BTC on its balance sheet, acquired by raising capital using zero-coupon bonds and other instruments.

Following their success, Bitcoin treasury companies became a fast trend.According to bitcointreasuries.net, there are now 160 publicly traded companies with bitcoin on their balance sheet, including names like Reddit, GameStop, Block, and Trump Media. Even an early-stage gold miner joined the party earlier this month, aiming to “seize the transformative opportunity [...] to lead the UK in bitcoin treasury management."

While many have converted only a fraction of their balance sheets into bitcoin, several are taking Strategy’s approach, centering their entire business model around bitcoin acquisition. So far, these high conviction firms have proven most successful of all

Twenty One Capital is one such company, founded this year with the explicit goal of increasing its shareholders’ “BTC per share” or “BPS” – a reimagined performance metric for a growing cohort of investors that use bitcoin as their benchmark.

“Measuring your performance in dollars is not that impressive,” said Jack Mallers, CEO of Twenty One, in an interview this week. “Bitcoin is the new hurdle rate. We want our shareholders to get wealthier in bitcoin terms. Instead of measuring earnings per share in dollars, we measure in bitcoin.”

What Strategy, MetaPlanet, Twenty One, and the like all realized is that bitcoin is not only an inflation hedge, but a marketing vehicle and growth supercharger. With a 60% CAGR over the last five years, they discovered that their simplest, most productive use of capital in most cases is to simply buy and hold bitcoin – with leverage.

With that, Bitcoin has its new narrative. This crypto cycle’s story is not one of Bitcoin holders rotating into altcoins, but of bitcoin ETF buyers buying into bitcoin treasury firms.

Whether this becomes the next crypto ‘blowup’ or this is, in fact, sustainable for these companies remains to be seen. But with such an unprecedented trend of businesses devoted to buying bitcoin, it seems altcoins will have a hard time soaking in capital from the bitcoin market the way that they once did.

Content Original Link:

" target="_blank">